WAYFAIR: ECONOMIC REALITY VS THE MARKETS

17 JUNE 2020

- 36 million Americans have filed for unemployment since March

- Unemployment rate is hovering around 14% (probably higher)

- Q1 GDP dropped 5%

- Supply chain disruption with China devastating US businesses

- Riots, race wars, looting, small businesses destroyed…

America (and the rest of the world) isn’t doing too well to say the least. But at least the stock market keeps rising!

If there was ever a time where economic reality diverged from the stock market, now would be it.

This quarantine got many of us and Wall Street thinking life from here on out will be all online. There’s no doubt that some of that is true: Classes are being run on Zoom (ZM), people are shopping more on Amazon (AMZN), and everyone I know has signed up for Netflix (NFLX) and Disney+ (DIS). Virtually every popular tech stock is making all-time highs. In the index-loving world we live in today, a rising tide lifts all boats, including companies that should be sinking. Wayfair is a poster-child of this paradigm.

Wayfair sells “products for the home” through five main sites: Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold. Their target audience is women between 35 – 65 years old. Revenues have increased at around 20% per year while they continue to lose more money on the bottom line and burn cash. It’s the epitome of a modern-day growth stock.

The shift to “everything online”

The Wayfair growth story is predicated on the market rapidly moving from brick and mortar to online. There’s no doubt that this is true. The question is, how much of total physical retail sales will shift to online? More specifically, how much furniture sales will move online? I don’t know. And I think anyone who spits out specific figures is either lying or guessing.

What I do know is, Wayfair is priced like COVID turned everyone into an online sofa buyer. I find that hard to believe for multiple reasons:

- I simply don’t believe people are buying furniture during a pandemic. Most people are focused on paying rent and buying food and household necessities.

- The demographic most financially devastated by the government lockdown is exactly who Wayfair sells too. People ages 35 – 65 are financially strained.

- Other age brackets simply aren’t buying furniture. Most people under 35 don’t need furniture (teens, college students, bachelors, etc.). And I’d be shocked if anyone over 65 knew how to shop online at all.

- Anyone who has bought furniture knows that it’s not an impulse buy. Furnishing your home usually involves some planning: fitting, matching textures and colors, arguing with your partner, etc. I find it hard to believe people planning to buy furniture at a brick and mortar before the lockdown would suddenly switch to Wayfair. They will most likely just buy on the brick and mortar’s online store or wait out the lockdown. In the long-term, I believe home furniture will be one of the items to survive the retail apocalypse. People simply like feeling out their cabinet and sofa before they buy.

Of course, there are some counter arguments:

- Retail is down and out. People stuck at home will find the Wayfair app or site and start buying furniture. This in part is supported by greater advertising leverage: less brick and mortar advertisers and cheaper ad rates.

- Since some people have to work at home, they will need to turn their rooms into offices. This will lead to a quick buy of desks, drawers, and office supplies. While likely true, I can only see this as a temporary boost lasting to the end of Q2/3.

Besides the questionable online retail hype, there are more issues threatening Wayfair’s share price.

The pain is yet to come

Wayfair operates in Canada, Germany, Ireland, United Kingdom, and United States. Unfortunately (or fortunately is you’re short), lockdowns across these countries started after mid-march, meaning its effects have yet to show up.

Q1 numbers were strong because they reflect performance before the lockdown. Q2 does not look as appealing. Could poor Q2 results and/or projections bring the stock price down? It certainly does not look to be priced in at the moment.

Many people are hopeful for a V-shaped or U-shaped recovery. The catalyst to bring about this recovery is the reopening of the economy.

Counter intuitively, I think reopening the economy will bring about another crash because it will reveal all the problems cause by the lockdown. Also, problems present before the lockdown will emerge stronger than ever: high consumer debt, leveraged stock buybacks, subsidized business models that would fail otherwise, etc. Just as a rising tide lifts all boats, a falling tide lowers all boats.

Cold war with China

Over 55% of furniture in the US comes from China. Similarly, the majority of products sold on Wayfair are sourced from China. Current views towards China are not friendly and Trump’s rhetoric doesn’t make the situation any more peaceful.

Will European countries retaliate for the damage China caused? Will Trump renew the trade war and increase his 25% tariff from phase 1?

Ignoring politics, COVID had to have awakened companies to the high risk of relying on China to operate a significant portion of their business. Will companies diversify their operations going forward? Such actions require capital and will likely be met with speed bumps.

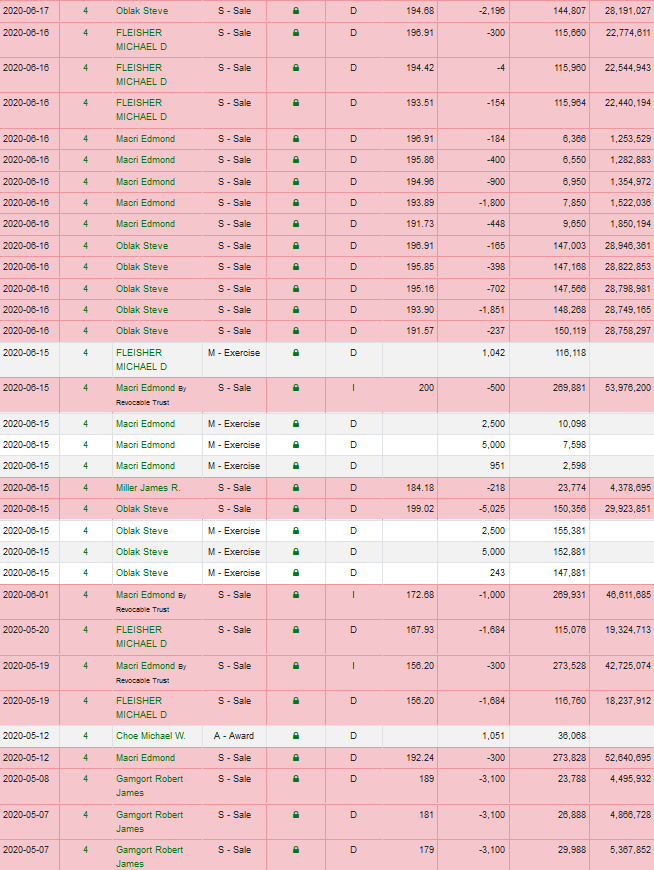

Look at that insider selling…

Do Wayfair insiders not believe in their own company?

Valuation and making plays

Is it even worth valuing this stock? There’s no rational reason this stock is trading at an all-time high given the current situation of the world and the amount of money Wayfair is losing. If investors are this irrational, surely valuations don’t really matter. That being said, let’s consider some things to gauge its price.

- Realistically speaking, Wayfair is worth $0 since it has negative equity. Could this be signalling an eventual bankruptcy?

- Is Wayfair really worth more now than before the lockdown?

- At $200, Wayfair trades at 1.93 times P/S, which is higher than many online retailers. Online retailers Revolve (RVLV) and Restoration Hardware (RH) trade at roughly the same P/S, but they have positive free cash flow. Only looking at sales, if Wayfair traded at 1.5 times P/S, they’d be worth $148.

Take valuation numbers with a grain of salt. Markets aren’t focused on proper valuations so whatever numbers you come up with will likely irrelevant.

If you’re willing to take a bet against Wayfair, I would focus more on the likelihood of events that will cause a perceptual shift. Going short just because of overvaluation is a coin flip.

And if you’re a crazy person who learned nothing from this article, feel free to go long.

Some other reasons why going short is a bad idea

- There is high short interest at around 30%. I wouldn’t be surprised if the recent move from the COVID bottom was fuelled by a short squeeze. At 30% short float, the squeeze may continue. You also have to pay 0.9% to borrow (see iborrowdesk.com for updated info).

- QE infinity is here. Who knows if some of that money is finding its way into online retail stocks? We might just be the next Weimar Republic. Even dog shit gets a premium price tag there.

- It’s a growth stock. If for whatever reason investors continue to love this company, momentum alone can push this stock higher.

Reality vs. stock price

The point of this article wasn’t to convince anyone to go long or short Wayfair. I wouldn’t do either.

The point of this article was to highlight how stock prices don’t always mirror reality.

As value investors, it might be tempting to go short when a company is clearly worth less than it’s supposed to be. But when prices diverge from reality, they can stay diverged for a long time- long enough for you to go broke.

“The market can remain irrational longer than you can remain solvent.” – John Maynard Keynes.

It’s times like these where you must keep in mind: you can lose money in the markets even if you’re thesis is right.