INTERNATIONAL CONSOLIDATED URANIUM: COPYING A PROVEN STRATEGY

30 MAY 2021

Welcome Reader,

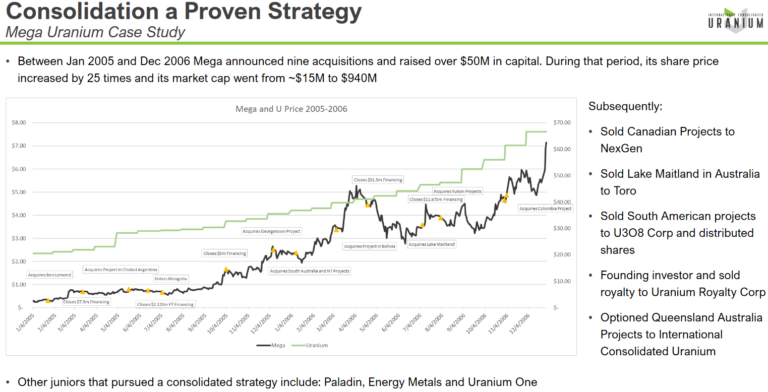

Mega Uranium was one of the best performing stocks in the last uranium cycle, returning 35,000% from 2000 to 2007.

Mega Uranium pursued a consolidation strategy. They bought uranium projects/mines early in the bull market and let them appreciate in various ways.

Many of NexGen, Toro Energy and U3O8 Corp’s mining projects were spun off from Mega Uranium late uranium cycle.

Can a company copy what Mega did last cycle?

International Consolidated Uranium is attempting to do just that.

Strategy overview

International Consolidated Uranium | |

| ISIN | CA45935R1055 |

| TSXV ticker symbol | CUR |

| OTC ticker symbol | LBHRF |

| Share price | CAD 1.90 |

| Shares outstanding | 37,498,507 |

| Market cap | CAD 62.3 million |

| Annual dividend | No dividend |

| Major shareholders | Mega Uranium (4%); Management (4%); Institutions including Sachem Cove and Segra Capital (40%) |

| CUR website | consolidateduranium.com |

Acquire

International Consolidated Uranium’s (CUR) plan is to acquire uranium projects, develop them and then spin them off when spot uranium prices peak.

Buy pounds in the ground cheap and sell them high.

At the peak of the last cycle, there were ~500 uranium companies. The ones that survived are the few names we are all familiar with: Denison, Paladin, Energy Fuels, etc. Most others didn’t make it. Many uranium projects were simply left for dead as companies couldn’t sustain them. With the uranium market still emerging from a decade-long bear market, CUR is able to scoop these forgotten projects for a bargain.

CEO Philip Williams claims CUR currently has an abundance of potential targets.

CUR aims to acquire projects across different geographies, stages of development and deposit type. The projects must also have significant previous expenditures and the ability to be developed efficiently.

Cash used to acquire projects are mainly raised through private placements.

Currently, CUR’s focus is on project acquisition since that’s where capital is most potent to delivering long-term returns.

“Our position is still that we can gain more value for shareholders by making accretive acquisitions than drilling addition resources. If I add another 2 million pounds of resources to any one of these projects, I don’t think that’s going to move the needle and it’s going to cost me a lot of money time and energy. If I spend 2 million dollars to get 2 million pounds in one project, I [instead] can spend two million as a down payment towards a 20 million dollar acquisition which we can get 100 million dollars of value in the market over time.”

– International Consolidated Uranium CEO, April 2021 webinar.

Put simply, pounds in the ground now are cheap relative to their future value. While spot prices are low, more value is gotten through acquisition than development.

Wait and develop

The pounds will automatically become more valuable as spot uranium prices rise. So one way CUR will generate value for shareholders is by simply waiting.

The other is to develop and advance their projects. As spot prices rise, it becomes more lucrative for CUR to develop projects as that will make the projects more appealing in a spinoff – much like a completed cake will sell for more than the individual ingredients.

Sell and/or continue to advance

Some projects will be sold off. In return, shareholders will receive cash and/or shares in acquiring company. CUR may decide to issue a special dividend.

In the case of Mega Uranium, they sold their projects too late – years after the bull market ended. Hopefully CUR will not make the same mistake. Though, it shouldn’t matter because I will suggest exiting before then.

The rest of the projects will likely be advanced by CUR in pursuit of producer status.

International Consolidated Uraniums' Assets

The following is a list of assets CUR has acquired.

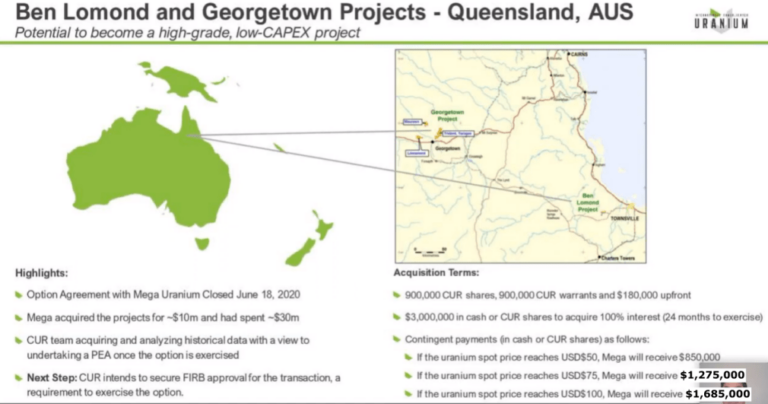

Queensland projects: Ben Lomond and Georgetown

CUR owns options on the Ben Lomond and Georgetown projects owned by Mega Uranium.

If CUR decides to exercise their option, they can choose to pay in cash or CUR shares. At the time CUR entered the option agreement, CUR believed paying full price to own the projects upfront would hinder their ability to acquire other projects, which is key to their strategy early in the uranium cycle.

Also, CUR bet that their share price would be much higher than it was when they entered the deal. If they decide to exercise, CUR will be able to pay with far less dilution. So far that bet is paying off.

Slides from April 2021 update webinar.

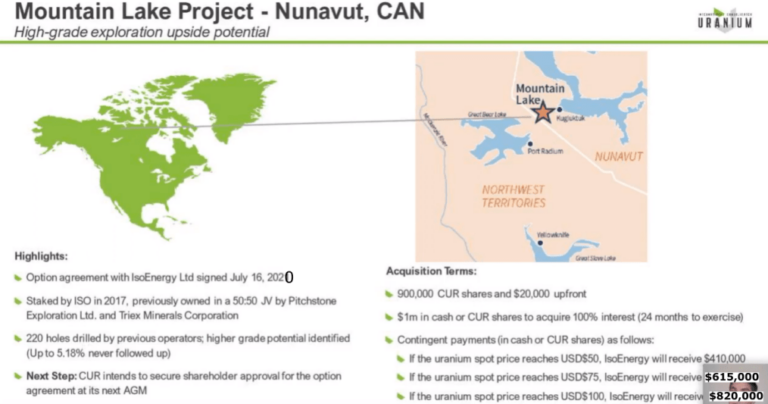

Mountain Lake

Option agreement with IsoEnergy for Mountain Lake. Same kind of structure and strategic thinking as Queensland projects.

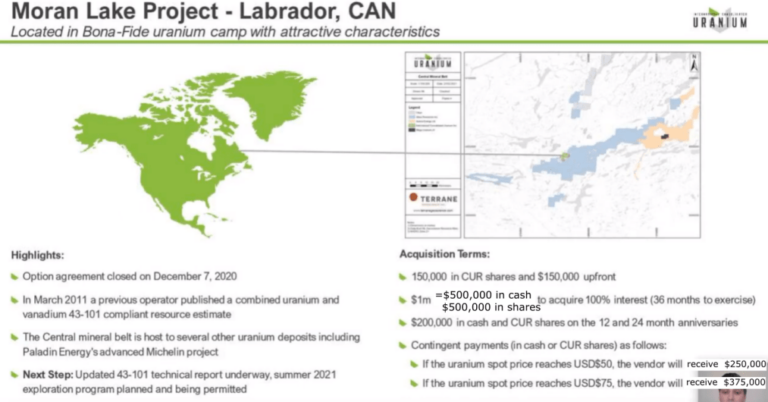

Moran Lake

Option agreement with private company for Moran Lake. Similar structure and strategic thinking as Queensland projects.

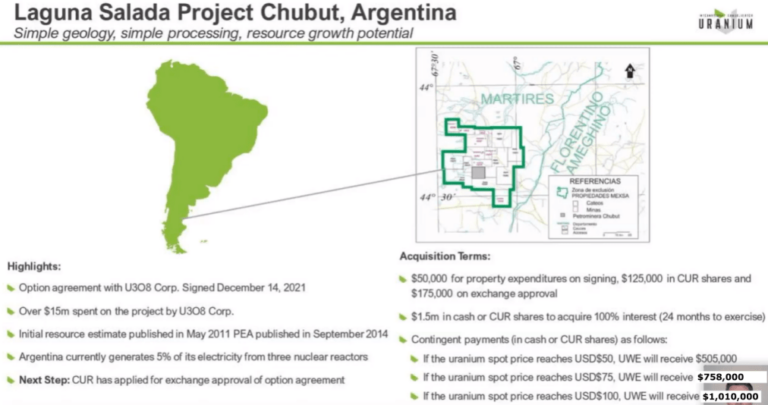

Laguna Salada

Option agreement with U3O8 Corp. for Laguna Salada. Similar structure and strategic thinking as Queensland projects.

Dieter Lake

On February 3, 2021, CUR announced it acquired the Dieter Lake project in Quebec, Canada. Dieter Lake is expected to have low holding costs (low cash burn to maintain). Details pending.

Matoush

On May 11, 2021, CUR announced it acquired the Matoush uranium project in Quebec, Canada. Details pending.

Kuulu gold project

CUR has options to own up to 70% of the Kuulu gold project owned by Meliadine Gold. It still needs land use licenses before it can explore.

Mt. Roe gold project

CUR holds 80% of the Mt. Roe gold project with Roe Gold Ltd. The project is still in early exploration stage.

As CUR is focused on uranium, I’d treat the gold projects as bonuses since they aren’t core to the business. However, they could become nice bonuses – and I am bullish on gold.

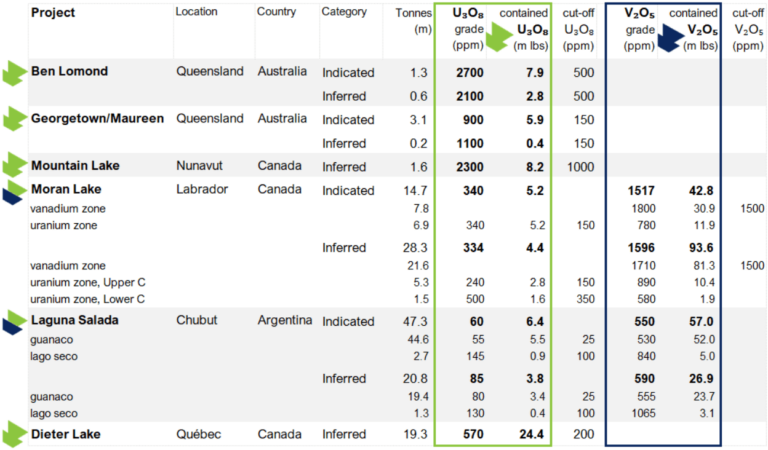

Here’s a table of the projects with resource estimates:

Copying success

Just so you know, International Consolidated Uranium is by no means a “great” company. It’s not a producer like Cameco or even ready to produce like Paladin or Boss.

But if it can copy what Mega did last uranium cycle, then CUR will produce amazing returns.

Resources

Is CUR using their capital effectively to increase their resources?

That’s an important question for CUR to answer since raising money and consolidating projects is the core of CUR’s strategy. And we don’t want them diluting us for nothing.

Ideally we want to see the amount of U3O8 increase proportionally to the number of shares a company is issuing; it’s even better if the amount of U3O8 increases at a faster rate.

Increasing U3O8 per share means we own more U3O8 per share than before and the company is putting money to good use.

| Date | Total lbs. U3O8 | Shares Outstanding | U3O8 per Share |

| 2020-06-30 | 17,000,000 | 14,063,229 | 1.2088 |

| 2021-02-10 | 69,400,000 | 35,400,000 | 1.9605 |

CUR has executed well on its first six project acquisitions. The first row measures U3O8 per share right after CUR’s first uranium acquisition of the Queensland projects. The second row measures U3O8 per share after the Dieter Lake acquisition. Indeed, U3O8 per share has increased over time.

I excluded their most recent acquisition of Matoush because we don’t have a resource estimate yet.

I also didn’t factor in the vanadium resources as the focus is on uranium. Adding in the vanadium resources will only make CUR look better.

Well managed

Continuing from the last section, it’s worth noting management is not diluting us to pay themselves fat salaries.

CUR is run and overseen by some heavyweights in the uranium industry including: CEO of NexGen Leigh Curyer, CEO of Mega Uranium Richard Patricio and former VP of exploration at Laramide Resources Peter Mullens.

CUR also has institutional investors such as Sachem Cove who are heavily knowledgeable on the uranium market.

Make your investment

So long as CUR continues to do regular private placements, I suggest buying around the price of the last placement (say up to plus 15%). This way you’re getting in at the same price as management and institutional investors.

The last private placement was on May 12 for CAD 1.80/share.

Of course, if we have a major pullback and the fundamentals haven’t changed, that’s when to back up the truck.

Want more stock & investment ideas?

There are many ways to profit off the crazy world we live in.

If you haven't read my investment reports yet, now is probably a great time to do so.