Hochschild, Bitcoin City, Omicron, Tech Short Update

To the Point 18-12-21

Peru the next Venezuela?

Peru’s President Pedro Castillo shocked Hochschild Mining shareholders on November 22 by announcing approvals to mines Inmaculada and Pallancata would no longer be granted.

Hochschild dropped 60%, then quickly recovered 100% as the government clarified Hochschild could “continue mining without further uncertainty.” Despite this statement, tension between the government and Hochschild remain. Today, Hochschild treads 20% below where it initially dropped.

My taste in Peruvian miners has definitely soured. Inmaculada alone represents 60% of Hochschild’s cash flow. The fact that 60% of Hochschild’s business can disappear overnight is a burden that’ll weigh the stock down. I doubt Hochschild will ever be a compelling investment until the political tensions are gone.

Hochschild is just one casualty. The truth is Castillo is taking it to the whole mining sector.

https://www.wsws.org/en/articles/2021/12/18/peru-d18.html

I’d stay away from Peruvian miners for now. The risk vs. reward is just horrible. If Peru wants to commit economic seppuku, so be it. What Venezuela did to its oil industry may be what Peru does to its copper, silver, lead and zinc industry. We can invest in miners elsewhere who will benefit from supply destruction.

Bitcoin City

Virtually all major countries today are moving towards higher taxes, increased regulations and more state involvement.

The one country that sticks out by seemingly going in the complete opposite direction is El Salvador.

El Salvador’s Bitcoin City is the antithesis to how the rest of the world economy runs: 0 taxes (except for a VAT), free market money, no central banking and minimal government regulations.

Bitcoin City plans to issue USD 1 billion in bonds. Half will go to building/maintaining the city, and the other half for buying more bitcoin. The City’s hope is that bitcoin will increase in value (relative to the USD they owe), making the repayment a lot easier.

Besides foreign investment, I’m guessing Bitcoin City will attract businesses to set up shop to take advantage of their friendly business environment. It’ll be a slow process, since (let’s be honest), El Salvador is still a bum place to live. It’ll start with “fringe” people like Max Keiser, and if the city continues to show promise, I can see it developing similar to free market city states like Hong Kong, all without a state-run currency.

Will Bitcoin City succeed?

If it does, it’ll be quite the adventure and success story. If it gets caught in a terrible bitcoin bear market and can’t meet its debt obligations, it’ll fail spectacularly.

Omicron variant is a smokescreen

I don’t know how many of my readers need to hear this, but the COVID [insert Greek letter] variant is more of a political issue than a health care issue.

So far, it looks like the Omicron variant is not lethal compared to Delta and Alpha COVID. However, it appears just as, if not more contagious.

The West will use Omicron as a smokescreen to do one of two things:

- States will use Omicron as an excuse to continue implementing restrictive measures.

- States will use the low death count as an excuse to claim victory for ending the pandemic.

It’s all a smokescreen for policy makers.

I get the sense that many people are getting fed up with lockdowns. Combine that with inflation problems, it’s finally probable governments will decide to end the pandemic and easy-money policy to get people back to work.

Our best investments on this site are indifferent to what states will do with Omicron. But if you haven’t priced in the latter situation, give it some consideration.

Update on tech short

This is an update on the tech short I published three weeks ago: https://fundamentalsfirstinvesting.com/state-of-the-market-inflation-yield-desperation/

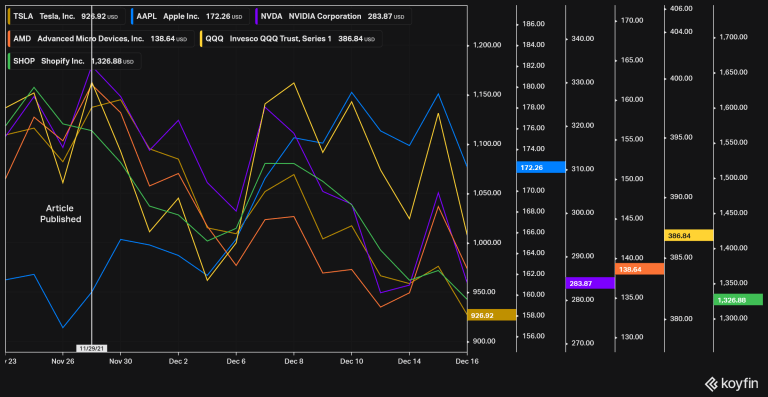

Most high-flying tech stocks are down around 15% to 20%. The exception is Apple, which managed to trudge upwards.

Shorting stocks would mean you’re sitting on a ~15% gain. Puts are obviously up a lot more. The March 2022 puts are around a double.

If you’re short the stocks, I’d hold (or continue trading if that’s what you’ve been doing).

If you bought puts, I’d sell half or all of my position, then look to rebuy (probably with more time) if the markets run again.

Consider reallocating some profits to shorting Apple.