INVESTMENT RESEARCH TOOL: SEARCH ENGINES

14 September 2020

Annual reports, blogs, articles, news and my investment reports (wink) are all great tools for researching investments.

But what if you want to search for ideas, news and articles? How do you do further research and find new information?

Most people would open up Google and type in whatever they are looking for.

The search results come back and most people don’t think twice about the results they’ve received. After all, the results are appropriate for the most part.

While Google is good, I think there is another search engine investors should use along with it: DuckDuckGo.

The problems with Google Search

1. Irrelevant results

Interestingly enough, one of the problems with Google Search is that it’s too good.

Google’s search algorithm works by analyzing your data and giving you results that they think you will like. Google snoops at your search history, YouTube views (Google owns YouTube) and websites you’ve visited to “adjust” their results to what you type in. The results are not necessarily related to what you’re searching for, but rather reflect your web activity.

For example, if I watch a video about gold jewellery on YouTube and then search for “gold mining stocks”, some of the first-page results will be links to jewellery dealers.

It’s like a child asking for chocolate ice cream, but his parents buy him vanilla since they’ve seen him eating vanilla before.

Furthermore, the results are not consistent locationally and temporally even if you search for the same thing.

If you live in Canada and search for oil market news, you will get vastly different results from a person living in the United States searching the same thing. The Canadian will get many articles on the Alberta oil sands while the American will generally get more global oil news.

I’ve had many instances where my search results from two days ago were different from today.

The reason results change over time is because the current events of the world were different two days ago. Google’s search results are event-driven based on what is trending around the world.

We’re left having to sift through the useless junk just to find what we want.

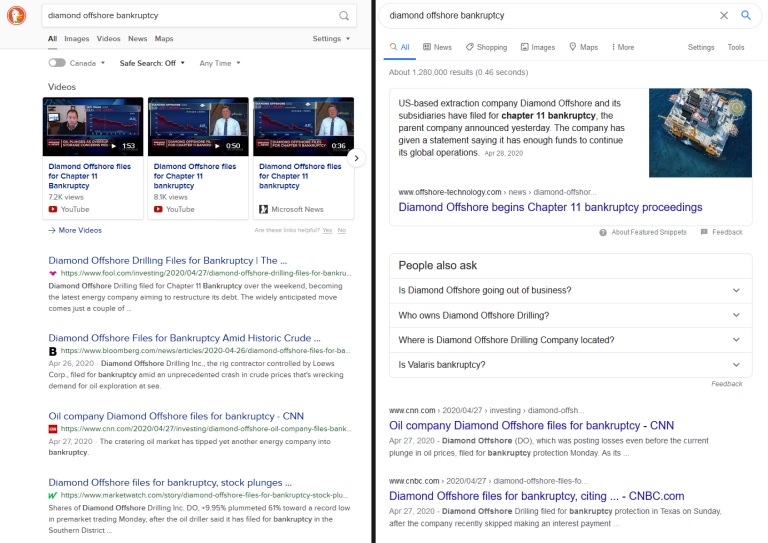

DDG vs Google

2. Too many ads

Often, the first page of Google’s search results is filled with ads. You have to scroll halfway down the page just to get to the first genuine link.

3. Too much news

The first page is also filled with news stories. Unless you are searching for news specifically, seeing a bunch of news headlines gets really annoying.

4. Privacy

This one’s irrelevant to good stock market research, but it’s a fact that Google looks at your personal data to “customize” your search results.

If you care about your privacy, consider another search engine.

DuckDuckGo solves all of Google’s problems

With DuckDuckGo, what you search is what you get.

There is no “search personalization” unless you directly ask for it. Without location filters, someone in Great Britain will get the same results as someone in America when they search for the same thing. Results also don’t change based on what’s “trending now”.

Ads on DuckDuckGo are optional. And if you choose to receive ads, they don’t take up a third of the results page like Google!

News articles only popup for trending events. Furthermore, there is no media bias – DuckDuckGo will show Fox News as well as non-mainstream media sites. Google often shadow bans right-leaning media sites and they never show non-mainstream media on the front page.

So DuckDuckGo gives you exactly what you search for without any censorship.

How to combine search engines for optimal research

While DuckDuckGo is my preferred search engine, that doesn’t mean Google isn’t useful.

I still think Google Search is better for researching sentiment and trends. The fact that Google peeps at everyone’s web activity is a double-edged sword. You get irrelevant results, but those same results reflect what’s trending around the world. Google’s results give you a better read on what everybody else is seeing.

What I personally do is:

- Use DuckDuckGo for most searches.

- Search news on Google to get an idea of an investment’s sentiment – is it popular, hated, unnoticed, etc.

- Use Google Trends for sentiment.

Combining both search engines gives you the best of both worlds: precisely what you’re searching for and a feel for what the world is thinking.

As a bonus, you can also use country specific searches to get an idea what the locals are seeing. On DuckDuckGo, this is done by switching your region. You can do the same on Google, but I think they track your IP address so to get the best region-specific results, you would need a VPN.

If you want to get deep in the weeds, use search engines that are built for their country of origin. For instance, use Baidu to see exactly what mainland Chinese people are searching for (wouldn’t fully trust the information since it’s all pro-CCP).

Hope this helps your investment research.