IS CHINA GOING BACKWARDS?

2 DECEMBER 2020

Ray Dalio said almost everybody is underweight China on CNBC.

I half agree. If I were to restate Dalio’s claim to reflect my view it would be: almost everybody is underweight developing markets.

It’s not that I’m completely bearish on China. I believe China has plenty of room to grow. If I had to choose between investing in a Chinese or US broad-based index fund, I’d choose the former. I just don’t think China’s economy is where we will see the greatest returns next decade.

The reason I’m not as bullish on China as Dalio is two-fold: (1) I believe other Eastern and/or developing markets offer better opportunities and (2) Xi Jinping is dragging China backwards, decelerating their economic and social growth.

China's increasing authoritarian policies

After the death of Chairman Mao, Deng Xiaoping took over and opened China up to the world. China adopted aspects of free market capitalism and the standard of living of hundreds of millions improved. China continued to liberalize until Hu Jintao came to power in 2002. He was arguably the first Chinese president to reverse decades of “opening up”. Hu certainly planted the seeds of Xi’s increasingly authoritarian policies, many of which are taking China backwards.

Here are few amusing measures:

- China’s major cities banned motorcycles. The CCP banned motorcycles to reduce air pollution, noise pollution and traffic. None of this makes sense since motorbikes pollute less and cause less traffic. In reality, the CCP banned motorbikes in major cities to increase face. The Chinese see motorcycles as “lower class.” Bike riders are “lesser humans” than drivers. Because the major cities became more affluent and function as interfaces to the Western world, the CCP wanted to remove any signs of impoverishment. That’s why you’ll never see a (gas) motorbike in a major Chinese city anymore.

How Chinese see each other (not sarcastic)

- The original music scene is virtually nonexistent in China. Asia has j-pop and k-pop but no c-pop. The reason is simple: Chinese people lack self-expression in part because the CCP does not tolerate freedom of expression. Imagine having to create a song with Xi Jinping ready to “disappear” you if the lyrics offend the Communist Party in any way. This is why China’s music scene is mainly composed of exported songs from the US, Japan, and South Korea. Same goes for other creative works like movies, TV shows and memes.

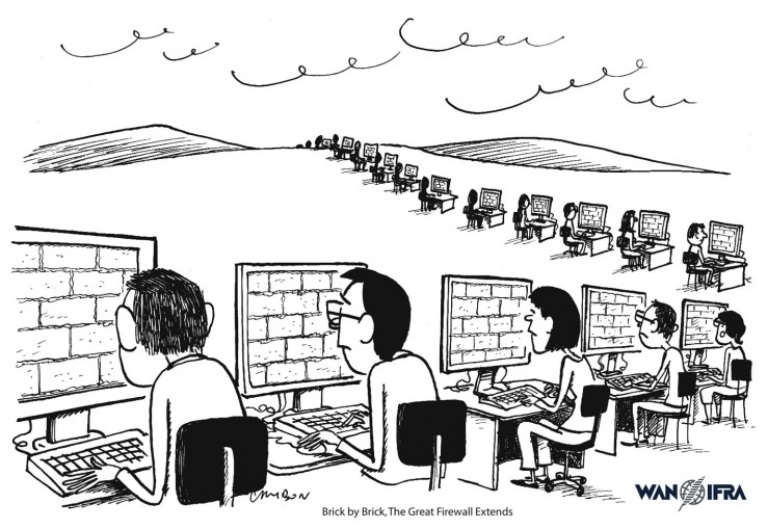

- Internet censorship has rapidly increased. China was slowly opening up until Hu Jintao came into power. Hu sought to expand the CCP’s influence on the world and domestic population through soft power and technocratic policies. To do so would require the CCP to maximize its control over information. This resulted in the ban of almost every site you can think of (not just social media). See for yourself. And here’s a list of popular blocked sites.

Censorship really accelerated under Xi and continues to this day. Even sites that have nothing to do with China or politics can be banned. So long as there’s a chance a site could post something negative about the CCP, it will be blocked. This explains why many tech review sites are blocked – I guess the CCP fears someone will put out a bad Huawei review.

The CCP’s authoritarianism is dragging China backwards

None of the authoritarian policies the CCP is implementing is conducive to raising economic growth. I could deep dive economic theory to explain why such policies are fundamentally negative for the economy, but I’ll appeal to your common sense to keep things short.

The idea that the CCP can ban an entire industry for a reason as superficial as “promoting face” is a massive deterrent for anyone thinking of starting a business. Imagine wanting to enter the Chinese market knowing there’s a good chance the CCP may regulate you out of business or ban you outright. Lots of people wouldn’t bother trying to run a business in China. The ones who do will have to pay the higher costs of government malfeasance, which the end consumer will pay.

It’s a lose-lose for the Chinese economy (and society). The only winners are the politicians and well-connected.

Certain industries will never thrive in communist China. By nature, creative people need to be able to express themselves freely, which cannot be done in China as long as the CCP wants to remain in power. Artists, screenwriters and singers can only produce media that fits the CCP’s narrative. Anyone who dares to create something that may offend the CCP will ultimately be censored.

China doesn’t have a comparative or absolute advantage in creative industries. This is why China will never become a net exporter of creative goods.

By having the Great Firewall, China essentially closes itself off from the rest of the world.

Communication won’t happen effectively. Information can’t be exchanged efficiently. Trade of goods and services will be restricted.

If you want to know how totalitarianism combined with extreme isolationism effects a country, just look at Edo period Japan, Uzbekistan under Islam Karimov or present day North Korea.

The Chinese Dream

When Xi came to power in 2012, his administration announced the idea of “The Chinese Dream.” The goal of the Chinese Dream is to get China to a “moderately well-off society” by 2021 and a fully developed nation by 2049.

In reality, the Chinese Dream is a ploy to align the Chinese population with the goals of the CCP.

The major difference between the American Dream and the Chinese Dream is who you work for.

In the American Dream, you are a free individual who works for the betterment of yourself, family and friends.

"The American Dream"

Stated explicitly, in the Chinese Dream, you are part of a national collective working for a better China. Implicitly, it really means you are working to grow the power of the CCP.

The reality of the Chinese Dream

In essence, it’s the individual and free markets vs. collectivism and socialism.

The return of central planning is pulling China backwards

A consequence of the Chinese Dream is more central planning. The CCP must take a tighter grip around private businesses so they don’t “compete” with the CCP in any way.

Small businesses remain relatively private and self-governed. They are mainly governed by the laws set by the CCP.

The command economy becomes more apparent in larger, influential businesses like Huawei, Tencent and Alibaba.

Chinese enterprises are required to have CCP members present when the board and management are making big decisions. Some companies have a special “CCP committee” integrated within. The aim is to make sure companies are aligned with the CCP’s vision. The more influential an enterprise becomes, the more the CCP has to get involved.

Ant Group’s (formerly Ant Financial and Alipay) IPO suspension on the Chinese and Hong Kong exchanges is a perfect example of a CCP power grab. Alipay became so widely adopted as a medium of exchange and digital wallet that it threatened state-owned banks.

The IPO suspension is what we get to see on the mainstream news. I’m certain the CCP is taking over Alipay behind the scenes as we speak.

Of course, the Chinese media will never tell you that.

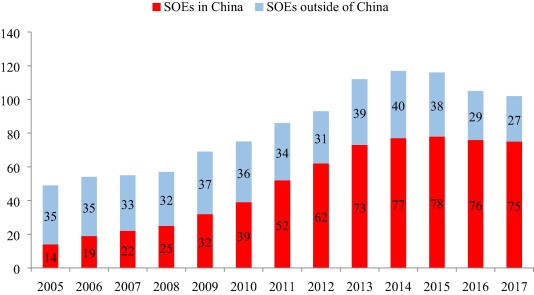

The number of state-owned enterprises (SOE) in China has steadily increased under Hu and Xi.

Having bureaucrats and politicians with zero knowledge of the businesses they are running is a recipe for disaster. Combine that with conflicts of interest and China is on a downwards slope back to the Chairman Mao days.

China can still grow

While China’s reversion to socialism paints a bleak future, China has an edge it didn’t have under Chairman Mao: productive capacity.

Unlike much of the West, China spent the last few decades building its industrial base. China can produce enough goods to satisfy its economic needs and then some.

The one caveat is China’s reliance on imported natural resources like oil and industrial metals. If China continues to alienate the world through soft power and militaristic pressure, it might run into some speed bumps securing certain imports.

Assuming China maintains a few trading allies, they should do fine.

A growing population, increasing consumption per capita and robust industrial base will hopefully offset any damage the CCP does.

Shanghai before and after (1990 vs. 2010)

There are better opportunities than China

I don’t see much reason to invest in China when there are better opportunities around the world.

If we look at the macro (major trends), Russia, the Eastern Block, Uzbekistan and some Middle Eastern and African countries are moving away from socialism towards privatization.

China is going the opposite direction! The government is taking over private businesses and property!

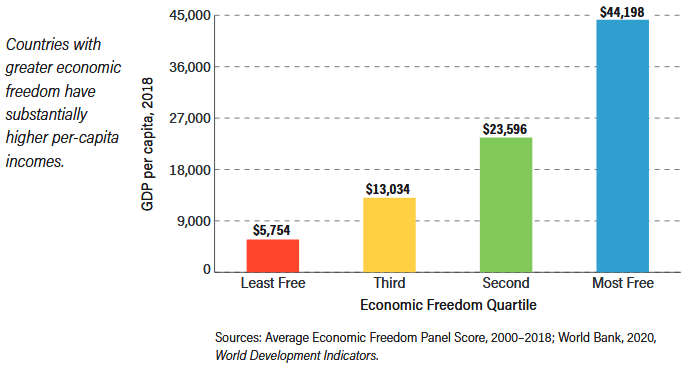

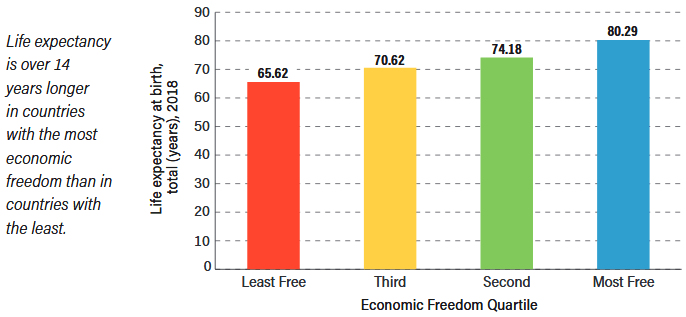

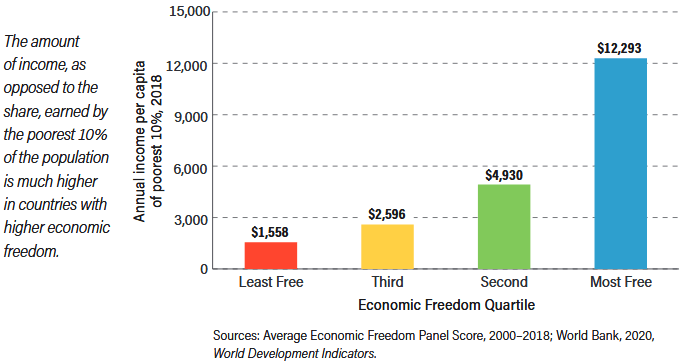

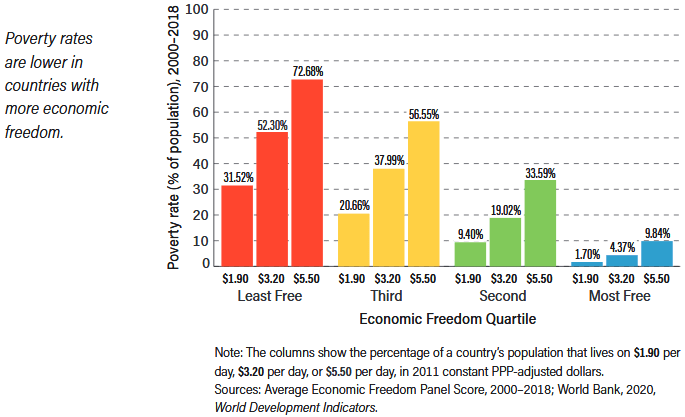

Even with China’s productive prowess, I don’t think the risk-reward is lucrative enough to risk investing in a country with shrinking freedoms. The amount of freedom is one of the best predictors of a nation’s success.

If we look at the micro (individual businesses), I see many multibaggers outside of China. That’s what my site is for!

As investors, we are always looking for the best return for the lowest risk. Right now, China does not offer that. With the direction China is going, I’d place my money in other countries and individual businesses.

P.S. When I’m talking about China, I’m talking about the country’s economy as a whole. So broad Chinese ETFs are not something I’m excited about. However, individual Chinese companies can still be great investments.