SEEING INFLATION IN REAL LIFE

8 JULY 2020

First things first, we need to define inflation. Most people think inflation is rising prices, but that’s wrong.

Originally, inflation meant an increase in the money supply, i.e., increasing the units of money in a system. When central banks/governments print and increase the supply of money, there is more money that can be spent on goods and services. But almost always, the supply of goods doesn’t increase at the same rate as the rate of inflation. If the amount of goods stays the same while there’s more money, each currency unit will be worth less; hence you need to pay more for the same thing.

You might ask, “If people have more money to spend then wouldn’t businesses produce more goods for people to buy and keep prices stable?”

No. Just use common sense. If inflation is 5%, is a baker going to bake 5% more bread each year? Eventually, he’s going to have to make infinite bread to keep prices stable. Obviously, there will be a time when his productive capacity can’t meet demand.

Consumer demand can be infinite, but production is finite.

So rising prices is not inflation, but a consequence of inflation.

There’s a lot to talk about on inflation, but I just want to point out some easy ways to spot the effects of inflation in your daily life. Simply knowing how inflation is affecting you will make it obvious that inflation isn’t beneficial like politicians and central bankers want you to believe.

Products keep getting more expensive

This one’s obvious, so I’m not going to spend much time on it. We’ve all experienced going to a restaurant or grocery store just to see the price tag blinding us with bigger numbers.

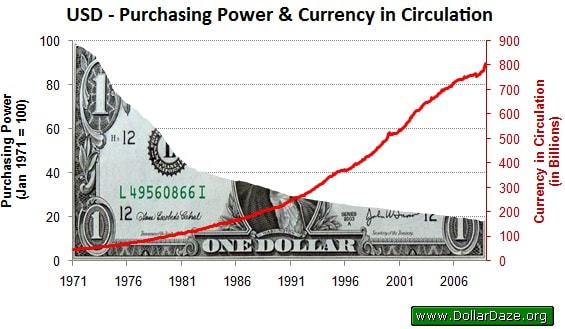

Inflation destroys the purchasing power of money, so you have to pay more for the same products.

Inflation at the grocery store

Pay the same, get less

Prices don’t have to rise for inflation to screw you over. Companies can just sell you less stuff for the same price (or more).

- Kid’s cereal had prize toys in the bottom. Companies used to entice kids to buy their cereal over a competitor’s by giving them a toy (or the chance to get one). Those days are long gone and now parents have to pay more for cereal that doesn’t even come with a toy. How sad…

- Taco and burrito restaurants used to be more generous when giving you ingredients. They would just dump a big scoop of beans or chicken onto the tortilla. But now, some chains are counting or weighing out their servings to make sure you don’t get one extra bean.

Cereals used to be fun

Cash is trash

Saving becomes a sin under inflation and rightfully so. If inflation is 2%, in 36 years your cash will be worth half its original value.

If you’re feeling an uneasy pressure to spend your money instead of saving it, you’re not alone. Inflation forces everyone to spend, spend, and spend.

Decreasing purchasing power

You tend to tip less

Because inflation causes food prices to increase, restaurants are forced to charge more.

I don’t know about you, it feels much harder to pay a 10% tip on an $80 meal vs. a 10% tip on a $110, even if the percent is the same. Catch me on a bad day and I’ll likely cheap out, opting to pay a smaller tip.

Rising stock prices

With all the extra money in peoples’ hands and no incentive to save, that money needs a place to go. Some people will invest that money in stocks, bonds, metals, and other assets, causing their prices to rise.

This doesn’t necessarily mean businesses are more productive and earning more. It can simply be people bidding up prices.

Inflation can get so bad that stocks rise during hard times. Just ask the Venezuelan’s and Weimar German’s.

Caracas (Venezuela) Index

The rich get richer

One of the problems with inflation is it exacerbates income inequality. Here’s one reason why:

The Cantillon Effect explains how money is unevenly distributed to people and why some people benefit more than others. When central banks print money, they need to distribute it. For various reasons (helping businesses keep employees, bailouts, loans, etc.) this money is first distributed to big corporations and banks before the average Joe. Big corporations and banks then use the money to continue business and invest, driving up prices (see last section). By the time the money arrives in the hands of the working class, they will have to pay disproportionately more for things than the first receivers. The result is an acceleration of the widening wealth gap.

Now you can see the evils of inflation wherever you go.