COVID Narrative Flips, Kazakhstan Riots, Tech Short Update

To the Point 08-01-22

Pandemic over?

The government’s COVID narrative is turning around. Look at the headlines:

- Joe Biden says: “There is no federal solution. This gets solved at a state level.”

- COVID isolation and quarantine period for general population shortened by CDC

- Stop Wasting COVID Tests, People

- Fauci: “Many [children] are hospitalized with COVID as opposed to because of COVID… They may go in for a broken leg… So it’s over counting the number of children who are quote hospitalized…”

All this seems awfully familiar, as if we already talked about it last year!

It appears the government is backtracking on many COVID narratives. Hopefully, this means they will let society move on.

If that’s the case, we can rejoice that COVID is finally behind us. However, the markets may not react positively because it gives the Fed and government an excuse to rein in inflation and take away easy-money policies.

Even if it’s short-term or all talk, markets may take a hit. I’ve talked about this more in the last To the Point and this article.

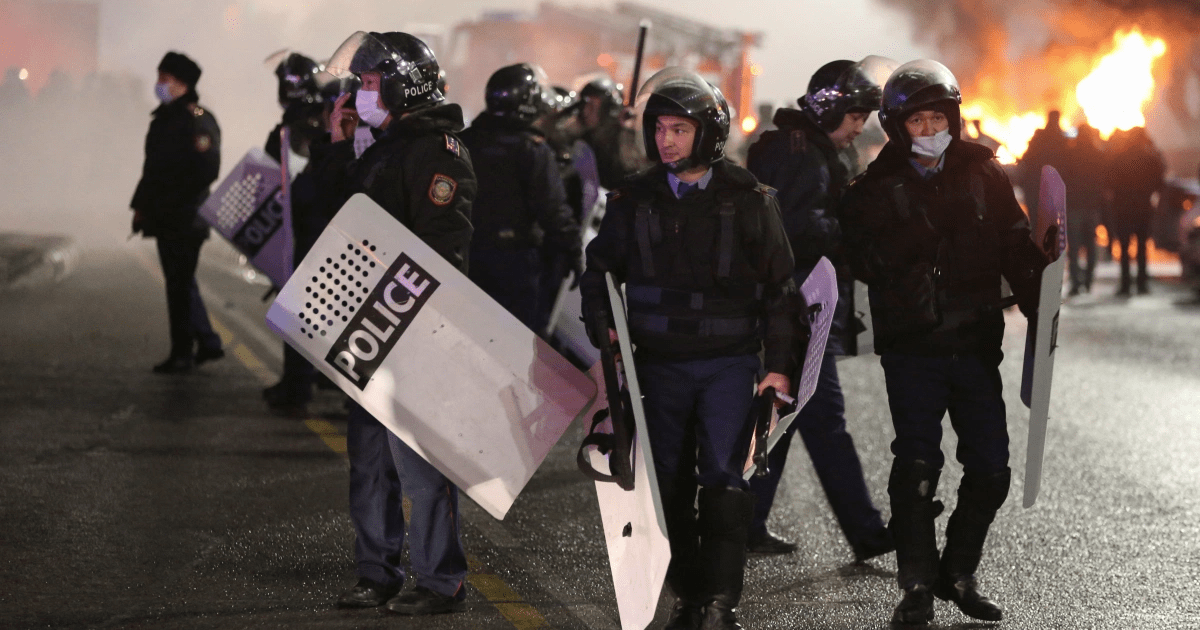

Kazakhs stand against their government!

The Kazakh government lifted its price cap on liquefied natural gas (LNG), causing gas prices to double. This sparked the Kazakhs to revolt against their government.

Also intensifying the issue is the involvement of Russia and the US.

For Russia, it makes sense why they have an interest in Kazakhstan’s affairs. Kazakhstan used to be part of the Soviet Union. And despite the collapse of the Soviet Union, many military and economic ties remain. For example, the Baikonur Cosmodrome is a launch area in southern Kazakhstan for spaceflights leased to Russia; Russia and Kazakhstan do anti-ballistic missile testing together within Kazakhstan; and Kazakhstan has large oil fields and uranium deposits which are linked to Russian energy operations.

To “protect” these interests, Russia has already sent 3,000 paratroopers into Kazakhstan.

For the US, why they have an interest in Kazakhstan is not as clear. We know that big oil companies like Chevron have operations in the oil fields near the Caspian Sea. So it’s almost certain Chevron is influencing politicians to give them an edge. There are also people mumbling about how the US sparked the riots to distract Russia from Ukraine.

I don’t want to go down any uncertain rabbit holes. The main ideas are: Kazakhstan is suddenly highly unstable, Russia is deeply involved in Kazakhstan’s politics and the US is questionably (trivially?) involved.

What does this mean for us and uranium?

In the extreme case, uranium production grinds to a halt. This would be sooo bullish for uranium because Kazakhstan makes up 43% of total uranium production (mostly from Kazatomprom). Taking out 43% of the world’s annual uranium production would create a supply deficit never seen before. Our uranium stocks would likely go up multiples overnight.

Another extreme case is Kazakhstan becomes so politically unstable that Russia has to step in to restore order. In essence, Kazakhstan would become a satellite state of Russia. Assuming uranium production doesn’t change, a Russian-controlled Kazakhstan would also be bullish for uranium miners outside Kazakhstan. This is because energy security wouldn’t be as secure for countries outside of Kazakhstan.

Don’t get your hopes up though. These are extreme cases that probably won’t happen. In my opinion, the most likely outcome is the riots sizzle out and uranium production remains unchanged.

Still, the whole debacle presents a couple of catalysts that weren’t there before. And the market hasn’t priced them in at all. Most uranium stocks are still down 20 – 50% from their recent peak. Uranium stocks are usually a buy on pullbacks and this is no exception.

Update on tech short – SHOP and AAPL

Shopify dropped 13% last week as the overall market slipped.

If any of you happen to be short Shopify, I would close my entire position.

Depending on how you shorted, you should be up around 25 – 500%. Take the sweet gains. Don’t cling to a short in this fugazi market.

Like last update, consider reallocating some profits to shorting Apple. If any other big, momentum, hyped-up tech stock runs up 10 – 20%, consider re-shorting them.

P.S. I have never specified how you should short certain stocks because everyone’s portfolio is different. I hope it’s obvious you shouldn’t buy $1 strike puts on Tesla. So I leave it up to you to find whatever method fits your portfolio best.

Personally, if I buy puts, I like to go about three months out and 10 – 20% below the current price. But please don’t copy if you think it’s too risky. You may want to be in the money or avoid shorting altogether.