Chinese Education, Afghan War, Tether Fraud, Ether Rock

To the Point 28-08-21

China education stocks get expelled

Waiting on Chinese education stocks was the right call. These stocks are down 90+%.

It seems the Chinese government killed private education/tutoring for good.

Supposedly, the CCP wants more people to have kids to solve their inevitable aging population problem. The CCP reasons the Chinese aren’t having more kids is because education is too expensive.

So the CCP’s solution is to ban education businesses from making a profit.

The plan sounded so absurd I thought it was a joke at first. Part of me believes this is just another power grab from the CCP in their expansion under Xi.

I guess I’ll never know the true reason the CCP did what they did.

As for other Chinese stocks, many have been beaten down in the last half-year. There may be some value to be found.

I’d just stay clear of stocks that have a high chance of getting killed off by the CCP. Or buy the stocks that have already been corrupted by the CCP or have political risk priced in.

Bitcoin, Cryptocurrency and Tether – the biggest fraud ever?

For convenience and price stability, people and exchanges hold stablecoins.

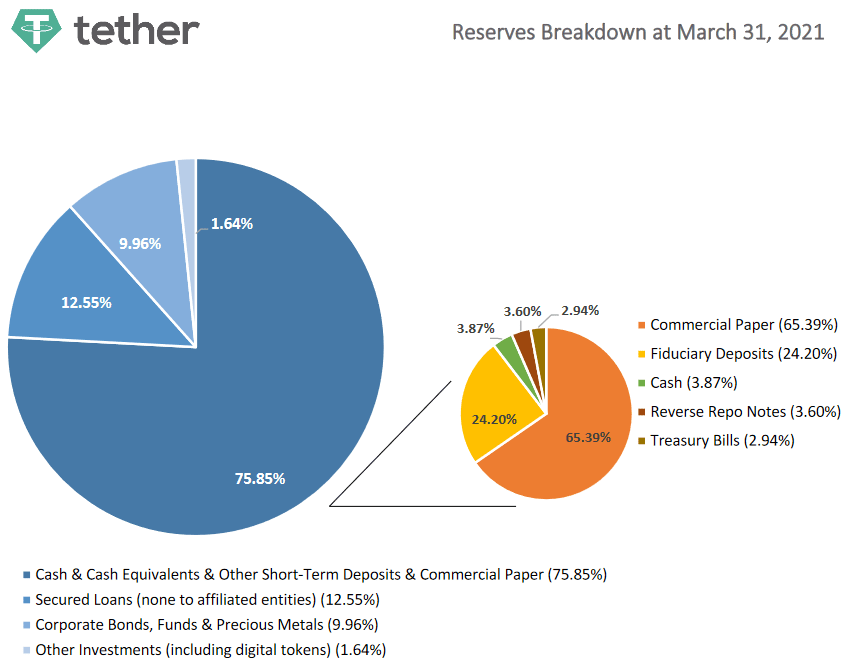

Tether is a stablecoin cryptocurrency backed one-to-one with US dollars. Meaning, every Tether coin has 1 USD backing it.

When someone buys a Tether coin, a Tether is printed. When someone sells a Tether coin, that person receives a dollar and the Tether is destroyed.

That’s how it’s supposed to work anyway.

In reality, there’s a lot of “funny business” going on with Tether. Namely, only 3% of Tethers are backed with actual US dollars.

Since a large volume of cryptocurrency and bitcoin transactions use Tethers, if there is fraudulent activity going on, bitcoin may see a temporary crash as transactional liquidity disappears.

If the reserves backing Tethers are insufficient, it also means people are overpaying for bitcoin and cryptocurrencies since there’s an artificially high number of Tethers chasing after them.

At the end of the day, if there aren’t sufficient reserves backing the Tethers and a Tether “bank run” occurs, there will be losers who will escape with nothing or less than they originally had.

Admittedly, people have talked about this possible fraud for a few years now, but recent events have resurfaced the issue. Listen to the following podcast for all the details if you’re interested in this issue.

In reality, there’s a lot of “funny business” going on with Tether. Namely, only 3% of Tethers are backed with actual US dollars.

Since a large volume of cryptocurrency and bitcoin transactions use Tethers, if there is fraudulent activity going on, bitcoin may see a temporary crash as transactional liquidity disappears.

If the reserves backing Tethers are insufficient, it also means people are overpaying for bitcoin and cryptocurrencies since there’s an artificially high number of Tethers chasing after them.

At the end of the day, if there aren’t sufficient reserves backing the Tethers and a Tether “bank run” occurs, there will be losers who will escape with nothing or less than they originally had.

Admittedly, people have talked about this possible fraud for a few years now, but recent events have resurfaced the issue. Listen to the following podcast for all the details if you’re interested in this issue.

The Grant Williams Podcast: Bennett Tomlin & George Noble

Peak everything

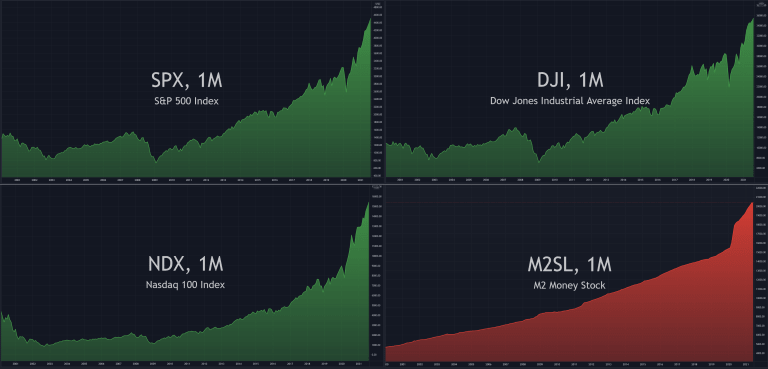

The SP500, Nasdaq and Dow are at all-time highs. Same goes for many Western markets.

The common factor driving everything to peak levels? Money supply (brrr).

Investors and bots flooded with cash are piling into the most “obvious” indexes and stocks. This explains why large-caps are carrying most markets while smaller companies are trending flat or being left behind.

Does this mean a market crash is right around the corner?

I don’t know. And I’d be sceptical of anyone who claims to know. Don’t forget that we’ve been making all-time highs since COVID started. Anyone predicting a crash would’ve missed out huge.

In my opinion, it’s best to invest in value and forget about timing the overall market. If it crashes, so be it. I’m confident the stocks we hold will fair nicely through a crash. And watching the market continue to climb higher is only shrinking your chances to take advantage of a crash if it happens.

We may not even have a serious (downwards) crash ever again. We may simply crash upwards in an inflationary crisis.

Stick to buying great businesses and assets. Small-caps, emerging markets and hard assets are prime hunting ground right now.

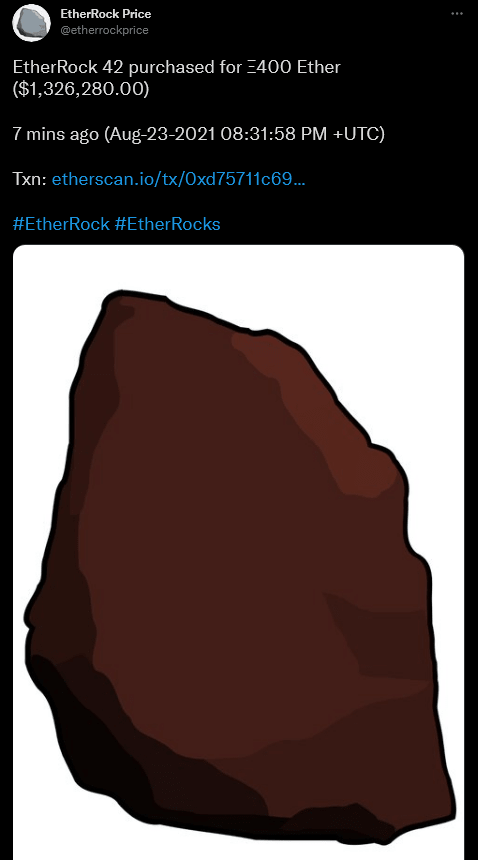

Peak LMAO!

No comment.

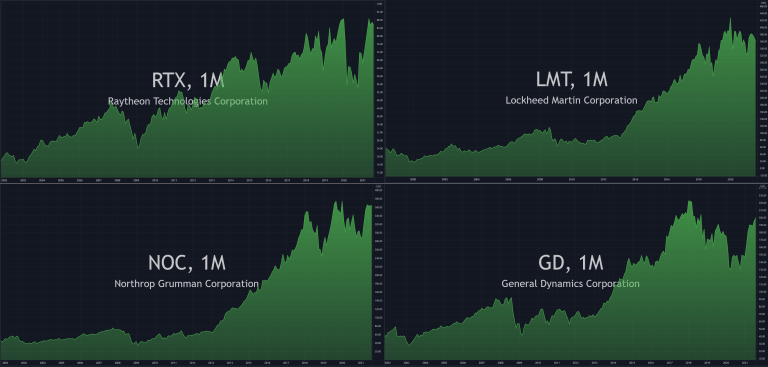

Afghanistan – a twenty year robbery

According to Brown University’s calculations, the Afghan War cost USD 2.261 trillion!

That’s around USD 300 million a DAY!

Straight from your pockets into the military-industrial complex.