Global Tax, Peru, Meme Stocks

To the Point 12-06-21

Global tax rate

So far, one reason that prevented governments from jacking up income taxes in their own country was that people and corporations could just move to a lower tax jurisdiction. We’re at a point in history where tax rates, particularly in the West, are high enough to force a large number of citizens and corporations to relocate.

The West’s solution?

A global minimum corporate tax with a starting rate of 15%!

https://www.reuters.com/business/g7-nations-near-historic-deal-taxing-multinationals-2021-06-05/

It’ll be interesting to see which countries plays ball.

News like this is only making highly autonomous city-states and anti-globalist countries such as Singapore and Georgia more appealing.

Also, monetary assets like gold, silver and bitcoin, as well as assets outside of countries participating in the minimum tax agreement will be sought after.

Election uncertainty in Peru

If you thought America’s election was highly contentious, you need to check out Peru.

Peruvian’s must choose between Marxist teacher Pedro Castillo and corrupt career politician Keiko Fujimori. (Dear Lord, save this country.)

What matters to us is Castillo wants to heavily tax (and maybe even nationalize) mining companies in Peru. If any of that were to happen, it’d be disastrous for miners – we have Venezuela as a template.

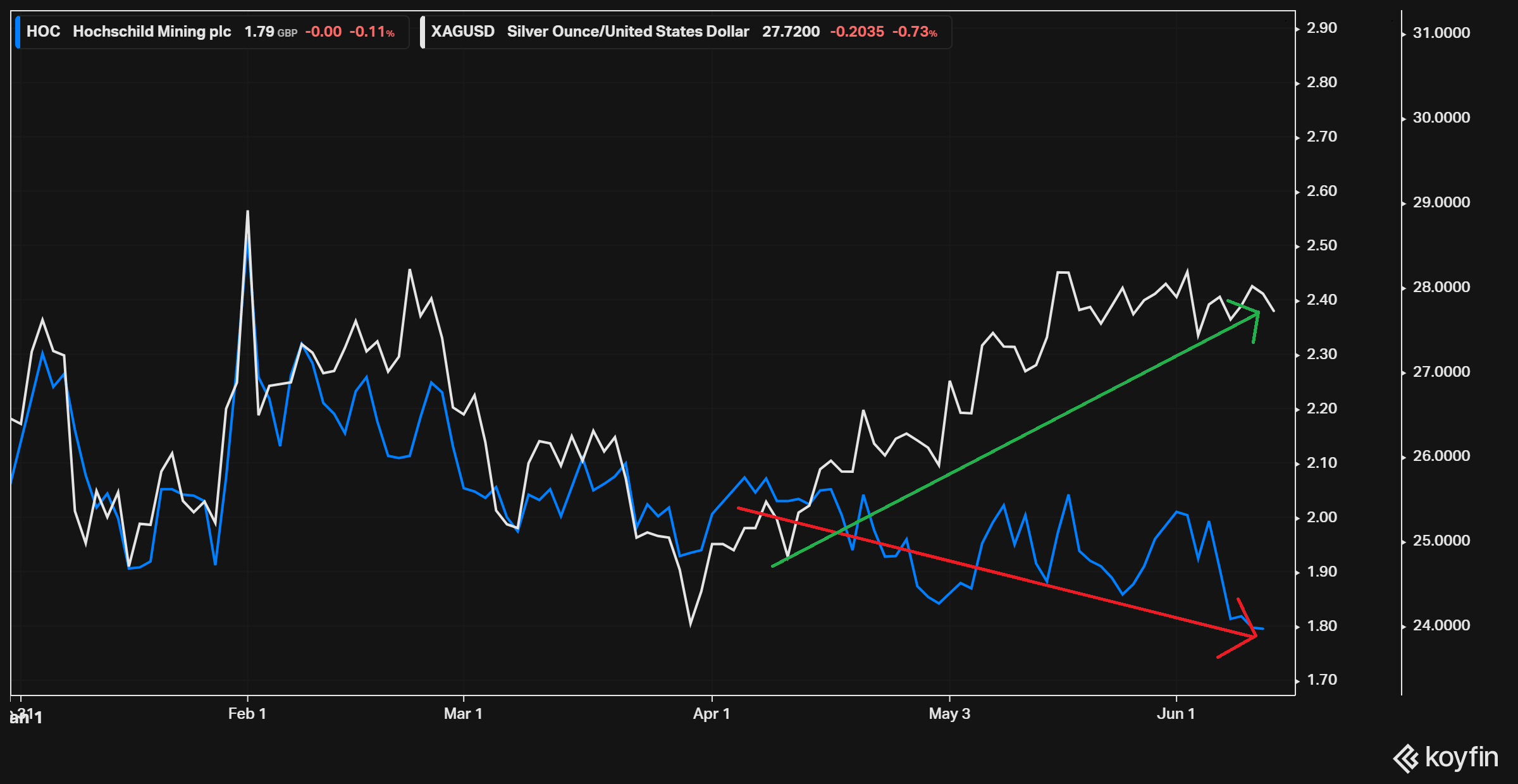

The fear of a Castillo win has caused mining stocks to suffer, despite increasing commodity prices. For example, silver major Hochschild:

The first round and second round of the 2021 Peruvian election took place on April 11 and June 6. The votes are still being counted.

Castillo currently has a razor-thin lead. And I really mean that – he’s ahead by less than 0.3%! Our opportunity is realizing a Castillo win and the damages he’ll cause are probably overblown. In reality, Castillo probably won’t nationalize any mining companies and he’ll have a hard time passing any partisan laws.

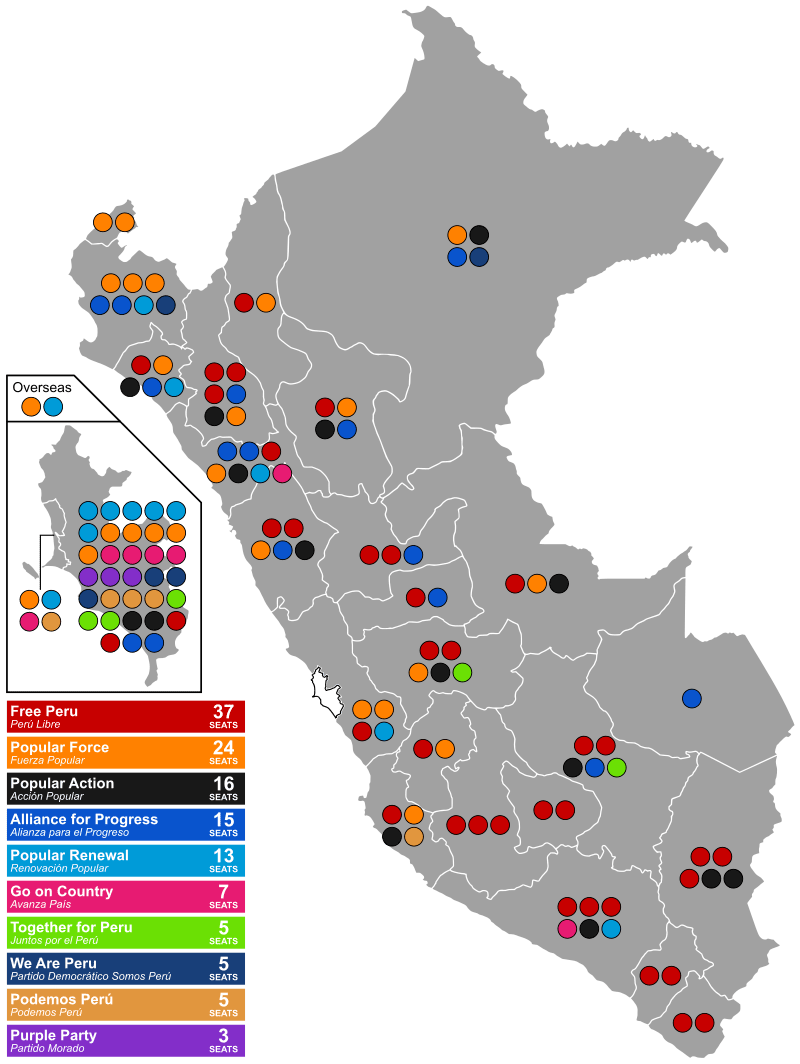

Let’s say Castillo wins. To implement his agenda, he needs to go through Congress which is predominantly right-wing. The only obvious support Castillo will get in Congress is from Free Peru, Together for Peru and maybe the Purple Party.

Unless he goes Hugo Chavez on Peru, the politics in Peru will remain in gridlock.

In that case, or if Fujimori squeaks by, Hochschild will likely be rerated +30% as political risks ease. Ditto for businesses in a similar situation.

It’s a bet on crazy politics to consider. You can also wait for the election results to finalize and play things from there – that’s the safer option.

Meme stocks are legalized bank robbery

AMC and other meme stocks are back. I guess the money from the bitcoin and tech selloff had to be gambled away on Reddit.

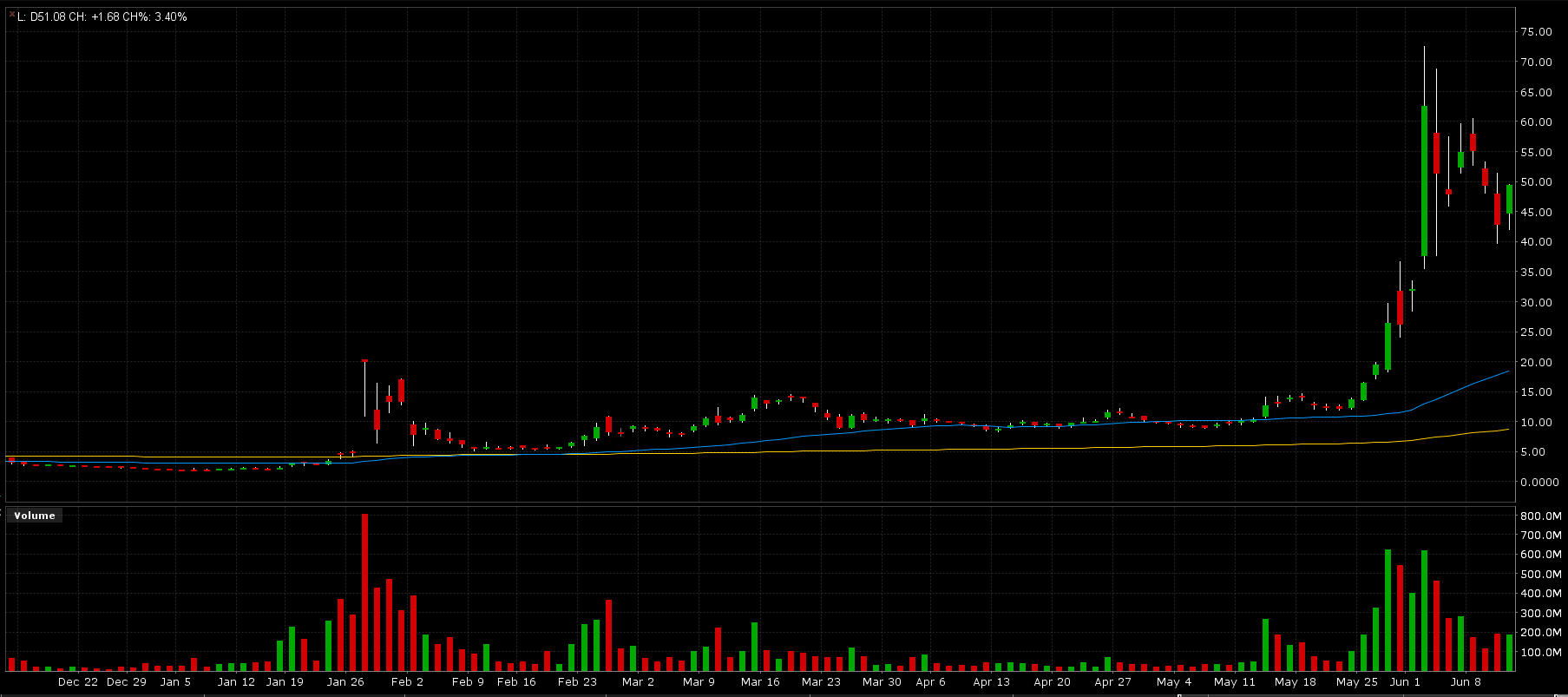

At USD 50 per share, AMC is a USD 25 billion company. GameStop last peaked around USD 30 billion. There are many more “Reddit Bettors” now, but there are also more meme stocks these guys have their money spread into.

I can’t promise this won’t rip higher, but my gut says AMC has peaked. At least, I don’t think AMC will triple. AMC would be a USD 75 billion company if that happened, which just sounds ridiculous.

Selling calls was like robbing a bank legally last week. People were literally paying close to USD 2 grand for the 18 June 145 strike call! (WTF…)

They were paying thousands more for contracts an extra week or two out.

Imagine making thousands of dollars just waiting a couple of weeks.

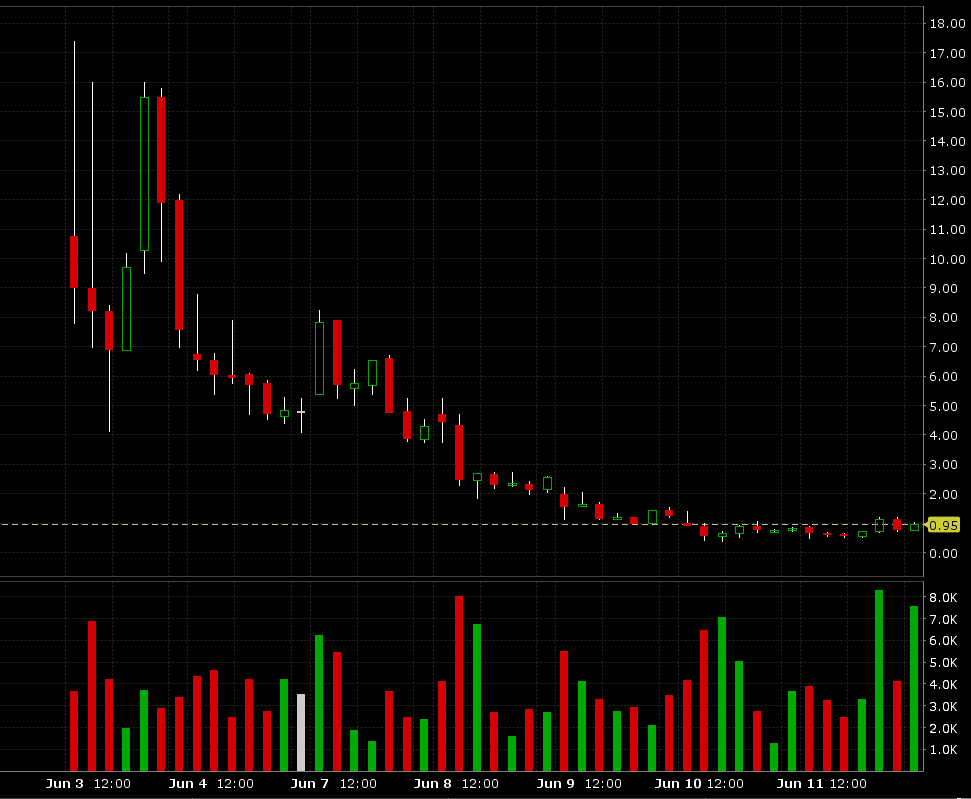

The call options have crashed in value, so you won’t be making thousands per couple weeks. But crashing from hyper-absurd to absurd still makes for a juicy trade.

The highest strike call option, currently at USD 145, is still trading for USD 250 to 460 per contract one to two weeks out.

If there was ever “easy money”, selling calls on AMC would be it.

Just make sure you have enough cash to cover or get out of the trade if things go upways (sic).