WHY CENTRAL BANKING LEADS TO A ONE-WORLD GOVERNMENT

26 DECEMBER 2020

The creation of the Euro, push for globalization and congregation of power and wealth among a few wealthy bureaucrats should not be surprising to anyone who understands central bank theory.

All of it was inevitable.

People are beginning to pass around the term “The Great Reset”. Although vaguely defined, The Great Reset is likely another push to assemble more power in the hands of the few.

I won’t discuss precisely what policies public officials will push to achieve their goal. That is a different discussion altogether, although my other articles and investment reports allude to what will take place.

Rather, I will show you why a one-world government will always be the conclusive goal from the creation of a central bank.

I am making no claims about whether a one-world government will actually exist or not. I am simply saying it will always be a goal public officials will strive for and creating a central bank is a crucial step towards that goal.

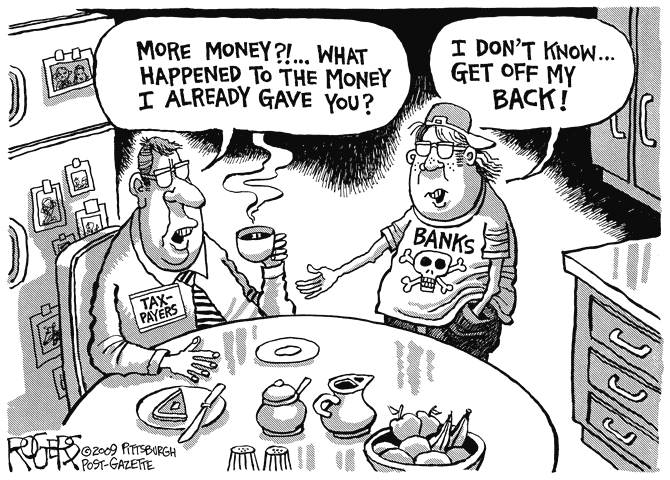

Taxes

By definition, a good is something that is desired and getting more of a good will benefit the receiver. Naturally, public officials will use their position to increase their wealth through various privileges they possess.

What’s the easiest way of collecting money from your citizens?

Just ask them! Or rather, point a gun to their head and force them to pay.

Taxes are the most direct way a government can increase their revenue. The problem with taxes is the state cannot increase their revenue much without facing repercussions. Namely, people will be less productive if their resources are constantly taken from them.

As such, taxes can only be raised so much before the government has to find another source of revenue.

Borrowing from banks

Just like individuals and businesses, the government can borrow money from banks.

The problem with bank borrowing is the government will have to pay interest on their loans. Banks also won’t lend to an entity that spends their money on non-productive intangible assets, which many government mandates are.

Both taxes and borrowing significantly limit the amount of money governments can spend. Thus, the government needs a way to overcome the limited tax revenue and decrease their dependency on private funds as a source of wealth.

The creation of the central bank

On December 23, 1913 congress created the United States Federal Reserve “to provide the nation with a safer, more flexible and more stable monetary and financial system.” Whether those were congress’s true intentions is debatable and a story for another time.

The creation of the central bank gave those running it control over the most saleable and accepted good: money. Such power in the hands of government was a hard sell to the public, who would rather have their money unadulterated. To prevent government from committing financial malfeasance, the Fed was created as a private entity separate from the government. However, over time, through wars and public programs, the Fed was increasingly needed to satisfy government spending, virtually morphing it into another branch of the US government.

Public officials now have the greatest range of control and freedom over how wealth is collected, gained, spent and redistributed in society.

Become a monopolist

At first, the government must become a monopolist over the production of money. This territorially defines money and prevents dissenters from switching to another form of money (unless they want to go to jail).

However, it is not enough for governments to monopolize the production of money. If money is a hard asset like gold (which it was before paper money), then governments will have to burden the high production costs of gold. In essence, commodity money physically cannot be inflated like paper money can.

Also, since commodities have usable value outside of money itself, people will tend to recognize that value making it harder for governments to spend recklessly. If governments debase or inflate titles to gold, then bank runs will occur as people rush to save their wealth.

Different forms of money throughout history

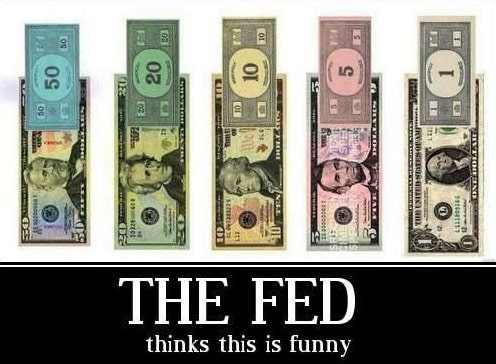

Thus, the next goal of public officials is to minimize the production cost of money and its quality. That is, make fiat-paper money the only form of legal tender in a given country.

Monopolize money titles and any money substitutes

In order to reduce the production cost of money, states must monopolize the production of money titles. That is, monopolize any form of representative currency where notes represent claims on hard assets.

By controlling money substitutes, the central bank can produce large amounts of representative paper notes without much cost.

However, this privilege still requires governments to hold gold reserves so people could cash in their banknotes (titles) for real gold. This is why the final step towards a pure fiat money is to cut the tie between gold and paper money.

Cutting the link between hard assets and fiat-paper money

The last step is to declare that paper money is not a title to any real asset.

Now governments and central banks can produce money at will with close to zero cost within their borders.

This is where the world is today.

Under each country or central bank system, a few public officials wield ultimate power over their currency. I hope it’s becoming clear how many public officials who seemingly produce nothing for society can become super wealthy and have so much influence.

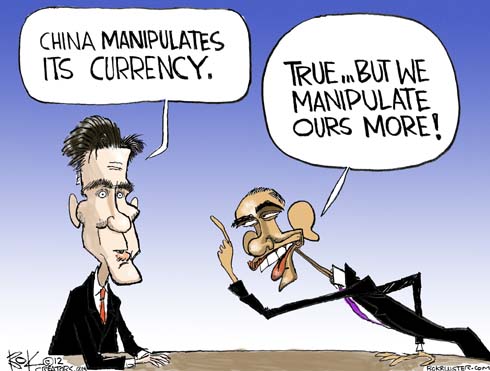

International checks and balances

There are still a few issues public officials face when wanting to produce as much currency as they want. These issues come in the form of international checks and balances.

If country A were to recklessly inflate more than country B, than country A’s currency will fall in value relative to country B’s.

The danger country A faces is that its citizens could abandon their fiat currency if it gets too weak. If that happens, the government of country A cannot manipulate its currency since there will be nothing valuable to manipulate.

Each currency keeps each other currency in check. So far, this is what’s protected citizens from getting completely ripped off by their government.

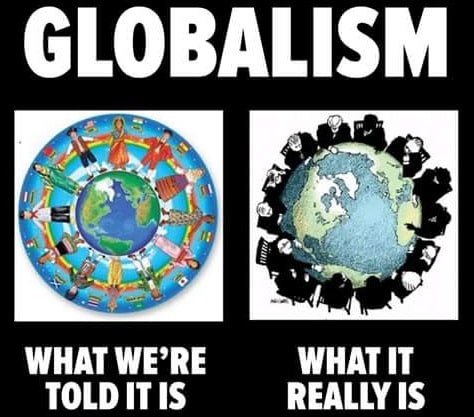

The one-world government currency

Naturally, for those in power, the solution would be to create a one-world fiat currency.

Under a one-world fiat currency, a few public officials wield ultimate power over one currency.

This would remove all competition between currencies and there would be no other currency for the one-world currency to fall against (by definition).

The Euro is a step in this direction. As of this article, the Euro killed 19 competing currencies.

Remember, the reason governments want to control money is because it is the most widely accepted good. Whoever controls the most widely accepted good, can produce it at will and exchange it for any other good will have immense power over everybody else.

The governing body of this one-world currency would effectively be the leader of a one-world government.

It is virtually guaranteed that inflation and financial malfeasance would be at its peak under a one-world currency. Transferring wealth from private individuals to public officials will occur at its highest rate, further increasing the gap between the few and everyone else.

Corruption, wealth inequality, poverty and other “bads” created under our current Federal Reserve System would only exponentially increase under a one-world monetary system.

I’ll let your imagination seek out what else could occur under a one-world government.

Going forward…

Again, I am not saying we will actually end up with a one-world government. It is merely the final goal for those in power.

If enough people wake up and decide against the direction of a one-world currency, the system will collapse. After all, fiat means “it shall be.” To defeat fiat we must declare “it shall not be.”

The current monetary system could just collapse on its own as well. After the collapse, if we revert to gold or some other money, that would also stop the one-world currency from happening.

I’ve also been thinking about how Russia could save us all from a one-world currency. Yes, I’m serious and yes, it’s a sad day when I think Putin might have to save the West. Russia is the only country that is self-reliant, financially responsible (or at least getting there) and has a strong enough military to stand up for the ruble or gold. Russia has also shown no interest in organizations like the EU. I may write an article on this topic later.

Regardless, I believe we need to be positioned properly. Not just to protect our wealth from evil inflation and financial malfeasance, but to take advantage of the turmoil and earn life-changing profits.