NO, MINING ASTEROIDS WILL NOT CRASH THE GOLD MARKET

3 September 2020

Recently, the Winklevoss twins told Dave Portnoy Bitcoin is a safer investment because Elon Musk will find a way to mine gold on asteroids. If Musk starts mining asteroids for gold, gold will suddenly experience inflation and become worthless. Or at least that’s their thinking.

Understanding of supply and demand is minimal

Many gold bugs, NASA and scientists also think mining asteroids will crash the gold market. After all, technology will continue to improve and we’ll eventually be able to mine asteroids. So aren’t we going to experience gold inflation one day?

No.

I’ll explain why in this article.

Framing the asteroid-mining world

There are many factors affecting the price of gold:

- Relative valuation: the price of gold correlates with other commodities and assets.

- Money supply: when the global money supply increases, so does the price of gold.

- Central banks: they buy and sell gold influencing its price. Central bank policy also affects the gold price. Ex: The Bretton Woods Agreement fixed gold at USD 35/ounce.

- Interest rates: negative real interest rates correlate with rising gold prices.

- Demand: the amount of gold needed for industry, jewellery, ETFs, etc.

- Supply: the amount of gold offered for sale at a given price.

Since we don’t live in an asteroid-mining world, I will create an imaginary one for the sake of this article.

In the interest of time and simplicity, I’m going to pretend supply, demand and relative valuation are the only factors affecting the price of gold. I will also assume asteroid mining takes place in a free market without any government or central bank intervention. Finally, gold is a form of money.

How mining asteroids will really affect the gold market

Suppose there is an asteroid filled with gold.

The only reason Musk or any miner will mine the asteroid is if the price of gold is more than the total cost of mining. Otherwise, the miner will lose money.

Even if a miner can mine asteroids, it doesn’t mean he will. The miner must think the operation is worth it before any digging takes place.

Now, let’s assume miners develop a way to mine asteroids profitably at the current price and supply of gold.

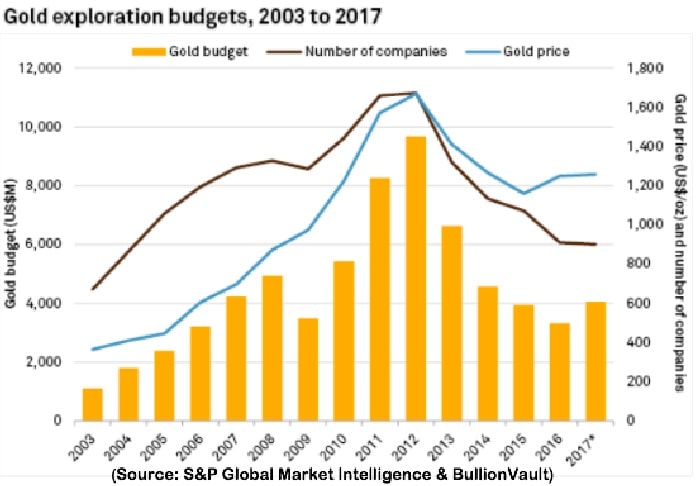

By mining for gold, the supply of gold will increase. When the supply of gold increases, by the law of supply and demand, the price of gold must decrease (assuming demand stays relatively flat). This trend will continue as more gold is dug out of the asteroid.

Eventually, the price of gold will be less than the total costs associated with mining it. At that point, there would be no reason the miner to mine, unless he’s a masochist.

To start digging again, the miner needs a new incentive to do so. One or a combination of three things can incentivize the miner to start mining again:

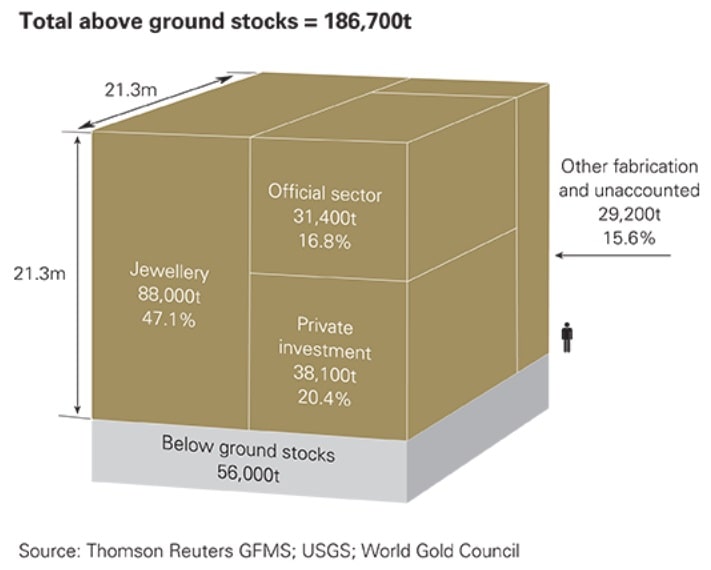

- Gold gets “consumed” and decreases the supply of gold. Because of the physical and chemical properties of gold, it doesn’t get “consumed” like oil, which turns into carbon dioxide gas. So the definition of “consumed” as it relates to gold is anything that takes it out of the market. This can mean anything from gold jewellery being stored in a drawer or gold being eaten and defecated out into the ocean.

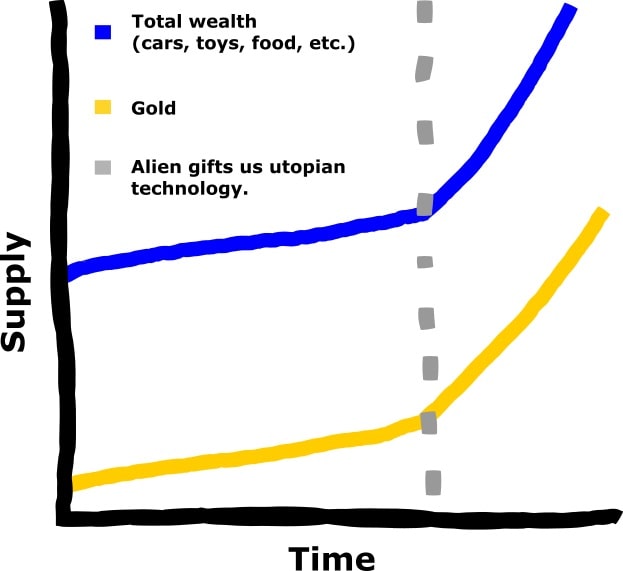

- The total wealth in the world increases. Gold (money) represents a claim on wealth, so if the supply of gold stays the same while the amount of stuff in the world increases, each unit of gold will have a claim on more stuff. This means the value of gold has increased – and eventually someone will go mine.

- The cost of mining asteroids for gold decreases. This can happen for a variety of reason, such as technology becoming cheaper to use.

Once the miner starts producing more gold, the price of gold will fall. And the cycle continues.

In fact, the same logic applies on Earth.

We don’t need to go to outer space to find out whether mining asteroids will crash the gold market. There’s plenty of gold on Earth that hasn’t been mined yet. We have the machines to mine it so why don’t we?

Because it’s not profitable and doesn’t create any value.

Total "discovered" gold on Earth

So no, mining asteroids will not crash the gold market because markets are inherently self-regulating. It doesn’t matter if Musk invents tech that allows us to mine asteroids. At the end of the day, everyone is bound by market forces.

Extreme thought experiment

Even if we discover a way to mine gold at a cost of 1 cent per ounce, it doesn’t necessarily mean the gold market will crash. It’s not just the direct operational costs that matter. The cost of developing technology that allows us to mine asteroids also matters. Such high-tech will likely cost a lot to develop and require a higher gold price to recoup the cost.

The only possible way mining asteroids will crash gold is if all the costs associated with mining gold shrink to dirt-cheap prices:

- Transportation

- Waste management

- Equipment

- Depreciation

- All others

Not to mention, the cost of developing any technology that allows us to shrink the above expenses must be low as well.

It’s almost inconceivable for that to ever happen since we’re essentially saying we’ll invent rockets and drills that are so efficient that they barely waste any resources and never go through research and development.

Maybe aliens can gift us the technology.

In spite of all this, a civilization with such efficient technology is probably extremely productive, producing products and services in quantities we can only dream of. With so much stuff (wealth), even if we mine a lot of gold, the wealth each unit of gold can claim should remain fairly stable.

If generous aliens can’t crash the gold market, I don’t think Elon Musk will.