FAIR VALUED GROWTH STOCK IN AN OVERVALUED TECH MARKET

14 AUGUST 2020

I think it’s safe to say the technology sector is overvalued, particularly the mega-cap stocks.

Part of me feels weird for saying that since out of all the companies affected by government lockdowns, Amazon, Apple, Facebook, Google and Microsoft are doing quite well.

But just because a company is doing well, doesn’t mean it deserves the stock price it has. Sort of like how you can be the best cashier in the world; it doesn’t necessarily mean you’ll make a $200K salary. Though, hyperinflation may make that a reality.

Whether a stock is overvalued or undervalued is fundamentally a subjective matter. While I see Apple being priced to perfection, someone else might see a company that can still take market share and innovate.

Although our perception of value is subjective, that doesn’t mean we can’t use objective data points to “frame” our perception of the world to better match “reality”. By looking at scrutinizing data and asking a lot of questions about a company’s (or market’s) valuation, we can narrow the range of its “true value”.

Not SP500, but SP5

Donald Trump says the stock market is coming back stronger than ever!

But if we take a closer look, most of the stock market (the SP495) is actually down. The only reason the SP500 is at all-time highs is because it’s being carried by the top 5 stocks (the SP5).

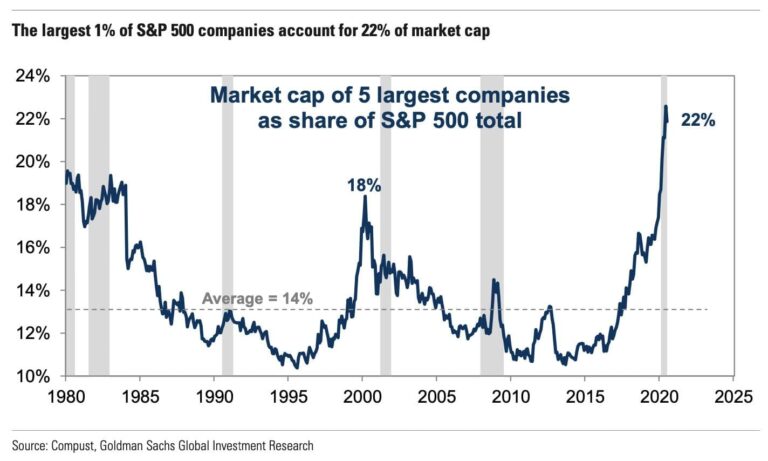

Another way to look at the sheer disparity between the mega-caps and everyone else is to see their relative size.

The largest 1% of SP500 companies are worth 22% of the SP500s market cap.

During the tech bubble of 2002, the mega-caps peaked at 18% of the SP500. We are now 4% above that!

Even on an intuitive level, is one-fifth of your quality of life attributable to Apple, Amazon, Google, Microsoft and Facebook? I hope to God not. The market is signalling these tech stocks are worth more to our society than many energy, healthcare and consumer staple companies combined. Companies that enable civilization to exist are being thrown to the wayside in favor of growth stories that may or may not live up to its price tag.

Apple

The Russell 2000 tracks 2000 small-cap stocks listed in the US. It’s arguably a better representation of the US economy than the SP500.

Guess what?

Apple alone is now worth $1.9 trillion, which is 90% of the all Russell 2000 companies combined.

If anyone can justify how Apple is providing more value to society than a couple thousand businesses, please let me know.

Tech as a whole

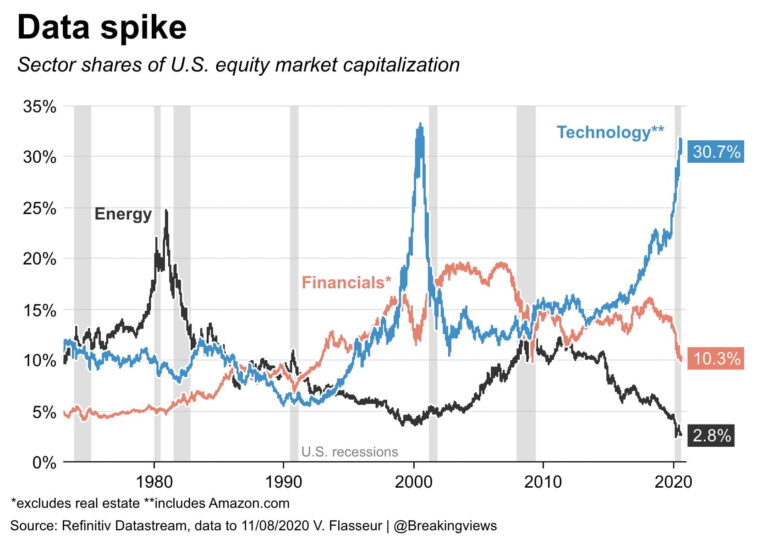

Tech as a sector is also rich by historical standards. Tech represents a third of all US equities by market cap; the same as the tech bubble.

However, I can see that being justified since tech is no doubt a larger part of our lives.

A more telling sign is how little energy equities represent as a whole. When/if we revert to the mean, energy will be the largest beneficiary at the expense of tech.

It’s worth noting, while I expect a reversion to the mean, I don’t think tech will ever fall like it did in 2002. Tech companies now are not as speculative as they were in the tech bubble. I don’t think the technology sector will disappear into oblivion, or even shrink for that matter. Tech is the future. The question is: how much are you willing to pay for that future?

After seeing some objective data points on the relative and historical valuation of tech, hopefully your subjective view of the tech market is better framed.

Finding a bargain in an overheated market

If tech is the future, we need to take part in it. But we should do so at a reasonable price!

Based on what I see above, nothing mainstream is even close to fair value. However, there is an industry within the tech sector that is growing like a weed and unnoticed by investors. The funny thing is, the industry is well-known in the western populace.

I found a stock that checks all the following boxes:

- A business in a growing industry.

- A business that has yet to take off in emerging markets.

- Leader in the industry.

- Very low-cost business model. High margins.

- Under the radar and not touched by “smart money” (yet).

- Undervalued to fair valued.

- Likely a multibagger in the next 5 years.

Investing in this stock is similar to investing in web hosting companies when the internet was not as popular.

If you’re interested in adding this growth story to your portfolio, you should learn about it in more detail. My latest research report discloses the stock – which has already been published for my members.