INVESTMENT IDEAS UNDER BIDEN PRESIDENCY: SOCIAL, DOMESTIC & MONEY

26 FEBRUARY 2021

Biden is president and the House and Senate are all under Democrat control!

While the media portrays Biden as a “moderate” Democrat, I wouldn’t count on any moderate spending or policies. The Overton window has shifted so far left I don’t think Biden could be moderate even if he wanted to. I expect the Biden administration to be like an extension of the Sanders/AOC campaign mixed with cronyism.

Check out this list of executive orders, memos and actions the Biden administration has taken: https://www.cnn.com/interactive/2021/politics/biden-executive-orders/index.html

Sort by topic and have a look at the equity, healthcare and education policies enacted.

Politics has consequences and opportunities. Here are some social, domestic, fiscal and monetary themes I see developing plus many investment ideas to play under a Biden presidency.

Healthcare

The Democrats want a single payer or fully socialized health care system. I doubt they’ll get what they want because of all the hoops they’d have to go through, but that is the trend.

The healthcare space is certainly going to have more government investment. I also feel there will be regulations sneaked in to dissuade smaller businesses from competing. Something like: “In response to the Coronavirus pandemic, the Biden administration has taken steps to improving the health/pharmaceutical care of all Americans. Now, businesses need to comply with XYZ.”

You can copy Warren Buffett and scoop up the large pharmaceutical businesses. Merck (MRK), AbbVie (ABBV) and Bristol-Myers Squibb (BMY) are his latest additions. He likes their moat and large dividends.

As we come out of lockdown, large pharmacies like Walgreens (WBA) will be administering vaccines, which in turn should drive up in-store sales. Walgreens has cut $1.5 billion in costs per year. After the vaccine rollout, Walgreens should be a cash flow machine with a 4% dividend.

I also expect money to move out of growth stocks in search of better real yields. The value names in healthcare and pharmaceuticals will reap the benefits.

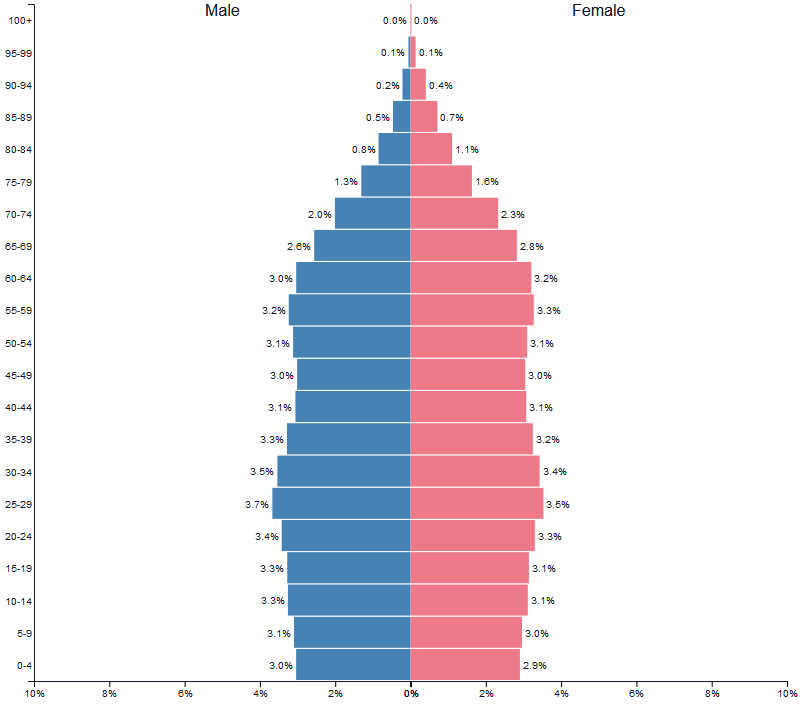

Another boon to the healthcare industry is the wave of retiring boomers.

US Population Pyramid 2020

We will see more people hopping on health insurance plans.

Check out online health insurance broker eHealth (EHTH). They sell various insurance plans from original Medicare, Medicare Advantage and small business. They’re Medicare segment makes up 88% of their revenue (2019) and is their fastest growing segment. That trend should continue as more people grow old. Sadly, due to lockdowns and less business friendly laws, many small businesses will never come back. Though in the long-run, this shouldn’t hurt eHealth much.

A word of caution: if the Democrats succeed in completely socializing healthcare, then health insurance companies like eHealth will be worthless. Who needs insurance when the government will pick up the tab?

Education

Like healthcare, the Democrats eventually want to socialize education and make it free for everyone.

Again, like healthcare, I don’t think the Biden administration will get us there but that’s the trend.

Among other things, Biden wants to:

- Triple Title 1 funding, which is the program funding low-income districts.

- Double the number of counselors and psychologists to help students with mental health issues.

- Invest in school infrastructure to improve buildings.

- Increase diversity in schools through improving teacher diversity and various social studies.

What’s the play here?

Well, there are some alternative education plays, mainly in online education/homeschooling. Check out Stride (LRN), Adtalem Global Education (ATGE), Strategic Education (STRA) and Grand Canyon Education (LOPE).

These stocks try to replicate or work alongside the current school system, giving customers more leeway on how they want to be educated. To be honest, the growth on these stocks isn’t great and their marketing is horrible. The above education businesses simply don’t have enough demand.

While K-12 parents are slowly turning against government-run schools, most end up sending their kids to private school or homeschooling them by hiring a private teacher or buying their own textbooks/courses such as those on Pearson (PSON.L).

It’s understandable since people who hate public education probably don’t want to associate with anything similar.

For post-secondary students, I believe people who are serious about self-educating will gravitate to specific online courses on sites like edX. The value of skills accredited by specific certificates rather than broad-based degrees will also rise in value.

If online school becomes more prevalent, something like Chegg (CHGG) would be a better buy (it’s quite inflated so I’d hold off for now). Chegg is Yahoo Answers, tutoring and textbook renting put together. Or for cheaters – paradise.

COVID definitely accelerated the online courses trend.

There aren’t many actionable investments in the education space (right now). It’s an industry to keep in the back of your mind just in case a future opportunity arises.

Guns!

Biden’s gonna ban all firearms. Or rather, he’ll institute universal background checks, license requirements and raise taxes on firearms and ammo which will make it impossible to buy a gun.

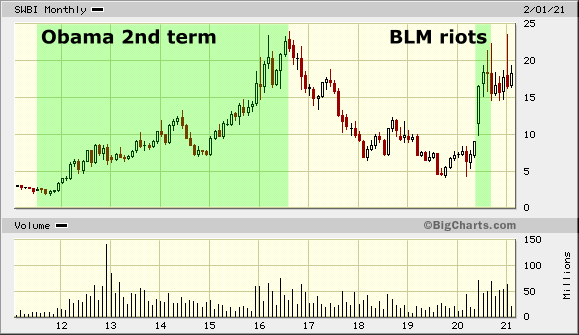

When Obama ramped up his anti-gun rhetoric in his second term, firearm and outdoor retailers rallied.

Smith and Wesson Stock Chart

People seem to forget firearm owners will buy more guns out of fear of having their rights taken away. Now that Biden has full control of the government, his chances of doing what Obama couldn’t are much higher.

If Biden marches forward with his anti-2A agenda, Smith & Wesson (SWBI), Sturm Ruger (RGR), AMMO Inc. (POWW), Vista Outdoor (VSTO), American Outdoor Brands (AOUT) and Academy Sports and Outdoors (ASO) – which currenly has high short interest – are bound to pop.

One thing stopping these stocks from going higher is there may not be enough buyers to fuel another rally. That’s because there was heavy gun buying when the Black Lives Matter riots were going on. Around 5 million new gun owners resulted from the riots. If Americans exhausted their gun buying already, we may see these stocks trade flat or down.

At current prices, firearm stocks are event-driven trades more so than value picks.

Mainstream media and news

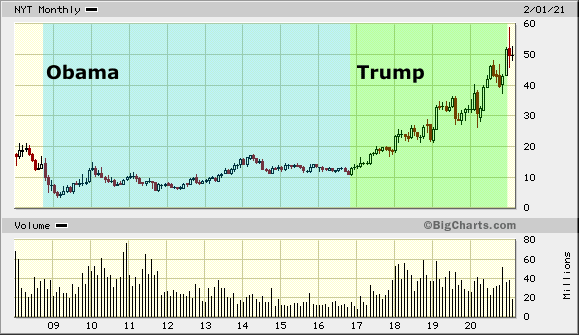

Let’s be real, Trump’s existence was pure profit for talk shows and MSM. All Jimmy Kimmel and John Oliver ever talked about was Trump.

I’d be sweating bullets if I were them now that Trump’s gone.

The New York Times (NYT) rallied huge during Trump’s presidency.

New York Times stock chart under Trump vs Obama

Controversy = profit.

But now that Trump is gone, I’m expecting ratings and viewership for many MSM channels to drop. It also doesn’t help that people have already been moving away from MSM to YouTube, Twitter, Reddit, Gab, Parler, etc.

If we weren’t in such an inflationary environment, shorting MSM like NYT would be tempting. Unfortunately, with money printers on overdrive and r/WallStreetBets hunting short seller blood, shorting is suicidal.

NYT is more likely to trade sideways like it did for much of the Obama era. It may be profitable to long option butterflies and condors.

Fiscal and monetary policy

Obama spent the last decade bailing out big banks with money created out of thin air. Most of that money went to recapitalizing banks (rebuilding their cash pile) so those dollars weren’t buying consumer goods and services. This is why we didn’t see huge consumer price inflation, but still saw stock prices rise.

Now, starting with Trump, the Fed is giving money directly to the people. Biden will continue what Trump started and then some. He and AOC are currently arguing about giving another $1400 or $2000 stimulus check.

Now that banks are out of the way and people have money to blow on real goods and services, consumer price inflation is inevitable. Inflation will hit the public like never before.

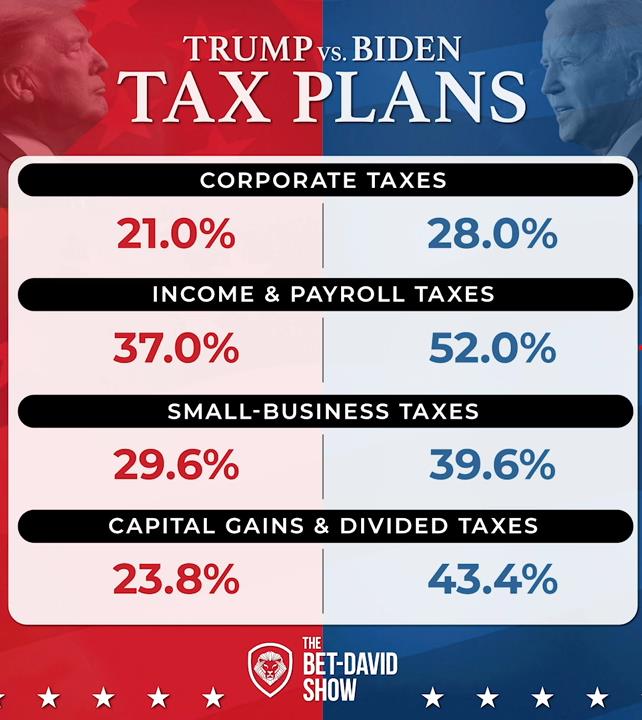

Taxes will also be raised. Below is a rough outline of Biden’s proposed tax plan.

I won’t go into detail about fiscal and monetary policy here since I already did in my gold report: Everything You Need to Know About Gold and Silver.

I’ll just assume you know the precarious position the West is in and talk about some plays.

In the near term (Biden’s first year), I wouldn’t be surprised if the economy did “well” since we’re recovering from a pandemic. But afterwards, you need to have a serious chat with yourself about whether you want to be invested in a country that is fixated on the policies above.

If yes, then you should have no problem investing in broad-based US index funds or companies that benefit from the US economy (just search them; they’re easy to find).

If NOT, then I suggest investing outside the West. For example, Jiangsu Expressway (0177.HK) is a toll road and GSH (0525.HK) is a railway. Both play on China’s overall development around major cities. I remain cautiously bullish on China as they are going backwards in some ways: https://fundamentalsfirstinvesting.com/is-china-going-backwards.

You can invest broadly in India through Fairfax India (FIH-U.TO). Some of their positions include Bangalore International Airport, Sanmar Chemicals Group and various financials.

Besides investing outside the West, owning hard commodities is a must.

Gold and silver are nice, although I like silver more – as discussed in my gold report.

I love various other commodities and energy stocks. I already dedicated an entire article to those ideas in my environment article.

Real estate in more rural areas and/or better run states and countries are solid long-term investments. It looks like many big cities are a no-go. California real estate is still expensive but the State is going downhill; not a good combination.

Indeed, I’m currently residing in Vancouver (major city in Canada) and all I hear is people wanting to buy houses and get into real estate. Besides capital flight from China, I don’t see why real estate prices will continue to climb. When everyone is talking about an asset, it’s usually time to abort.

Final words…

I can’t see the future being anything but chaotic. Politically, people aren’t coming together; they’re choosing sides. The only unity we will see is between ideologically similar groups. After the MSM and Democrats blasted Republicans for four years straight, I can’t see many Republicans wanting unity. On the other hand, while Biden says he wants unity, are Democrats willing to accept Republican ideals? I doubt it.

I don’t think both parties truly want unity. Only the government wants some resemblance of unity… But that’s a discussion for another time.

Meanwhile, the worst thing you can do is let the chaos eat you alive – physically, mentally and of course financially. Whether on your own or with me, make sure you’re wealth is at least secure; even better if you can profit.

“Chaos isn’t a pit. Chaos is a ladder.” – Petyr Baelish (Littlefinger)